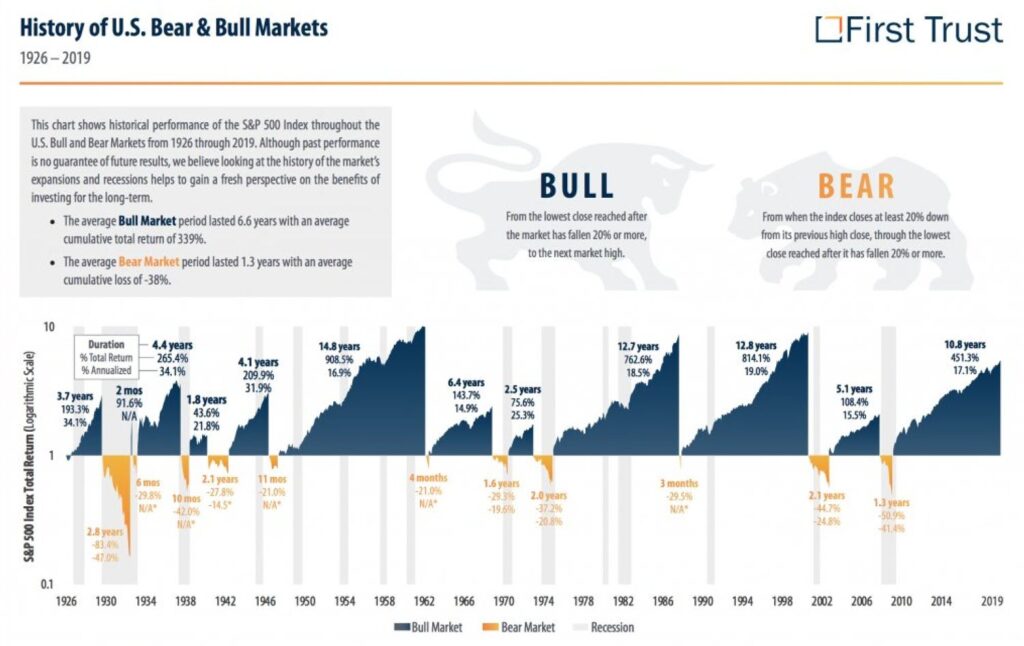

Make More Money in Bull Markets

You can make more money by staying put when the market is doing well (bull market), instead of worrying too much about losing money when the market is doing poorly (bear market).

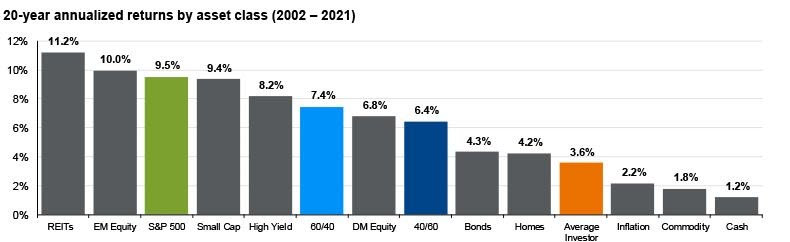

Investors Can Be Their Own Worst Enemy

Sometimes investors can get in the way of their own success. What causes them to not do as well? Their own actions.

What’s the crux of their underperformance?

Their own actions.

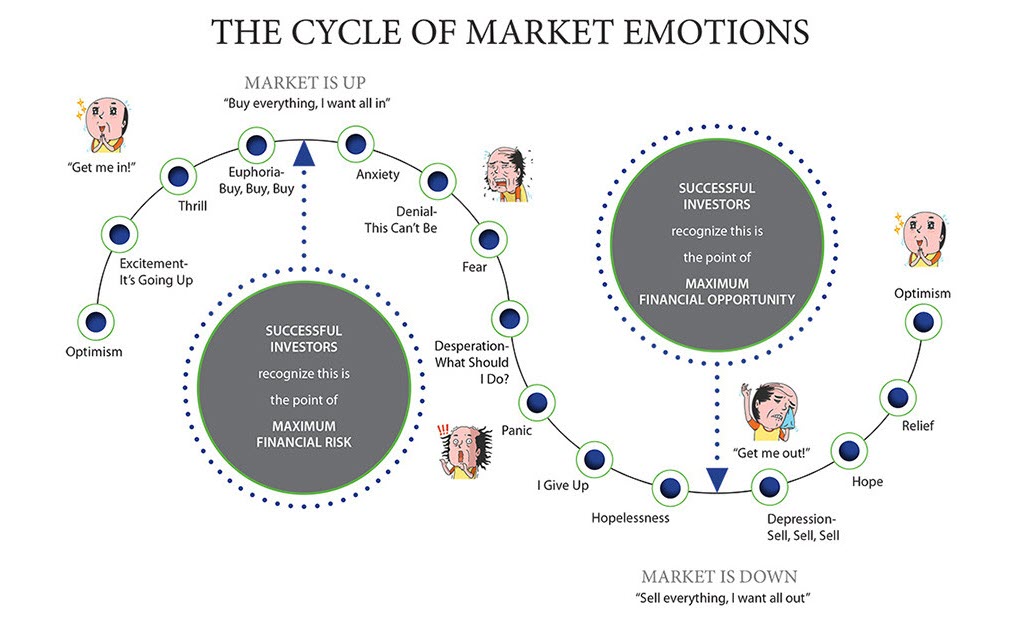

Market Cycles Can Be Like Rollercoasters

The ups and downs of the market can really affect how investors feel.

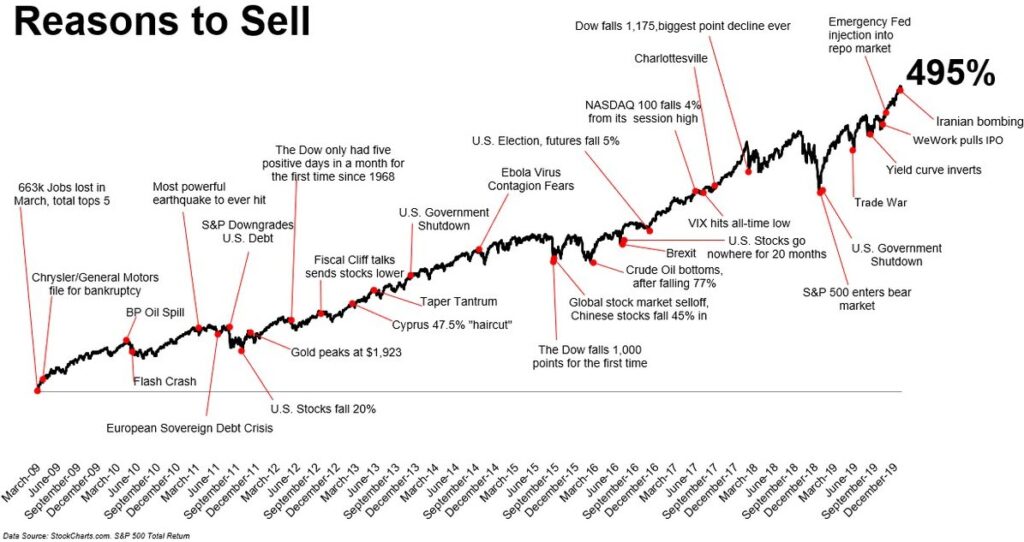

Resisting the Urge to Sell

There’s always a reason that sounds smart to sell your stocks, but resisting this urge can often be better.

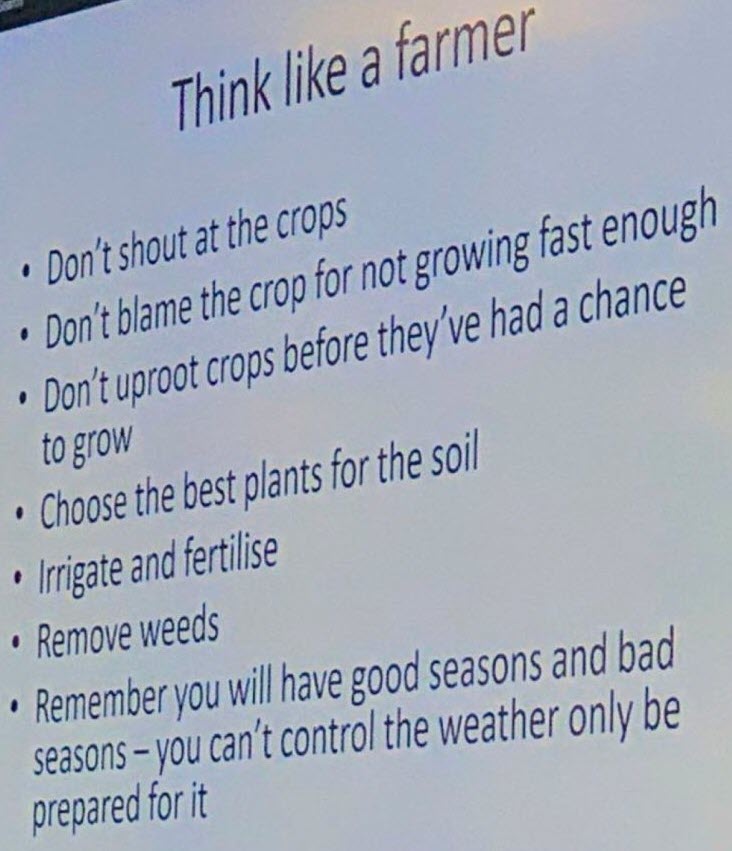

Be Patient Like a Farmer

When you invest, try to be patient and caring like a farmer is with his crops.

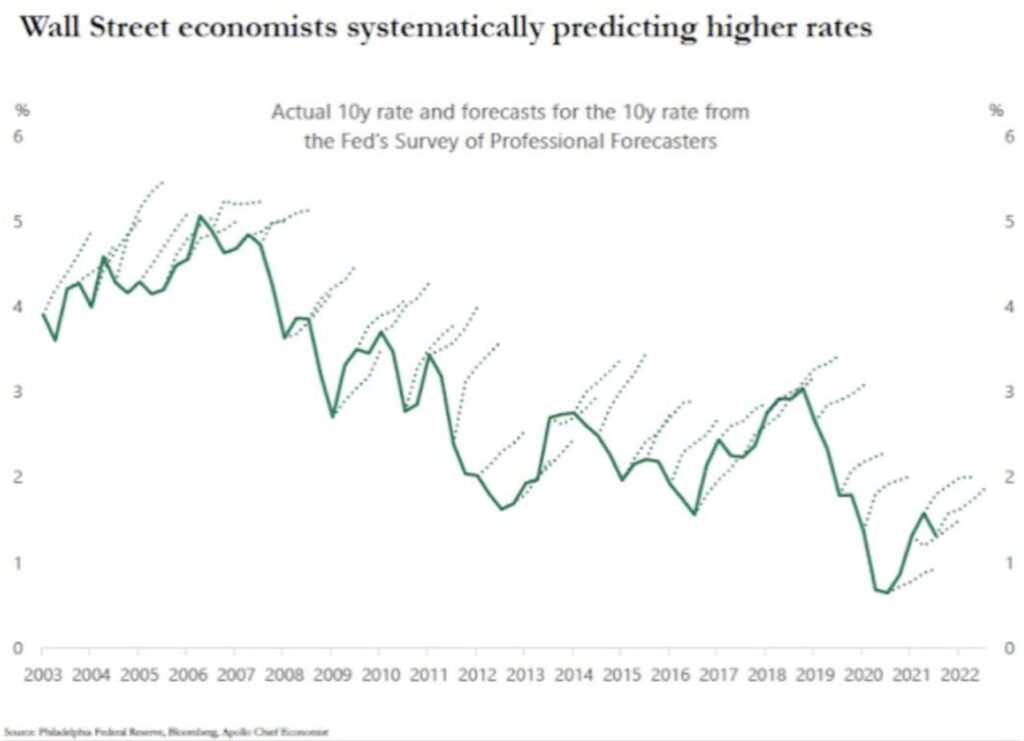

Ignore Predictions

It’s hard even for experts to predict things like interest rates. So, it’s better to not pay much attention to these predictions.

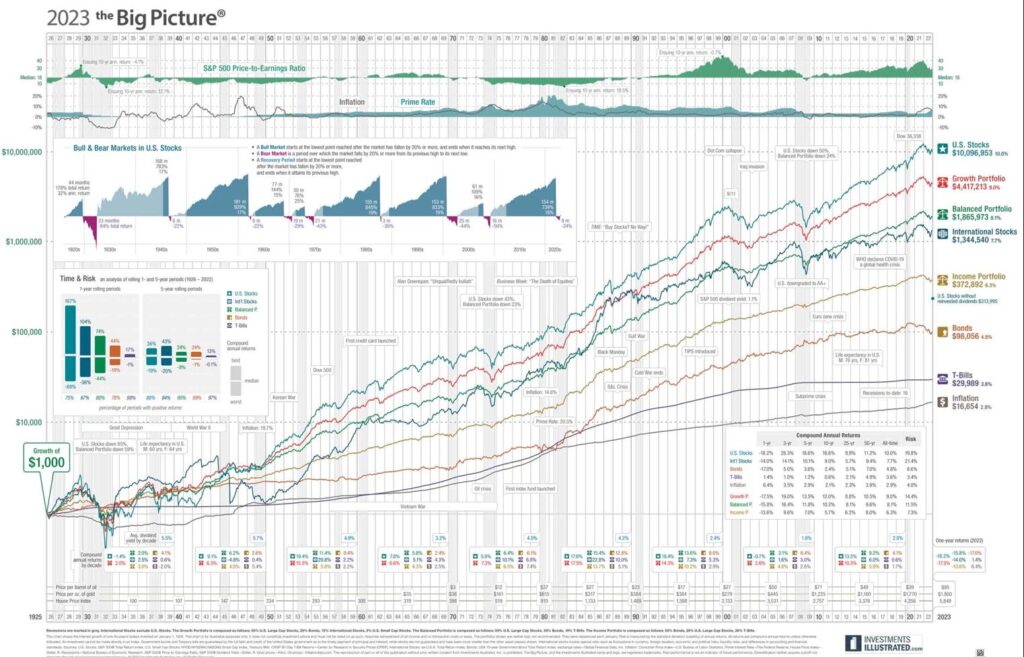

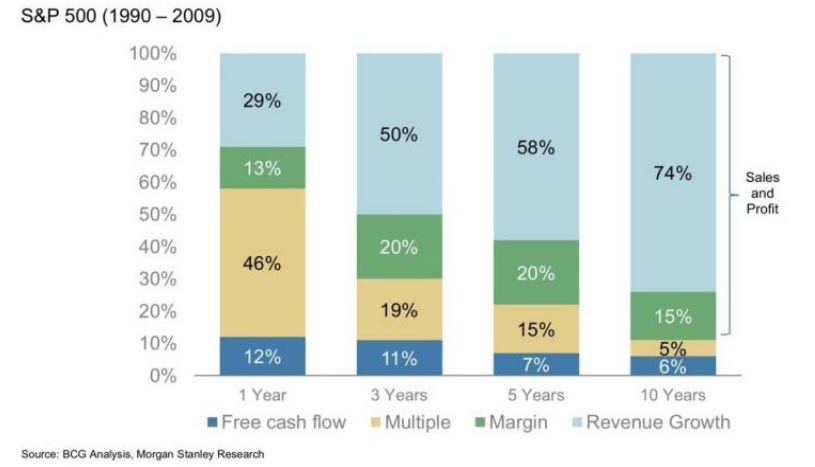

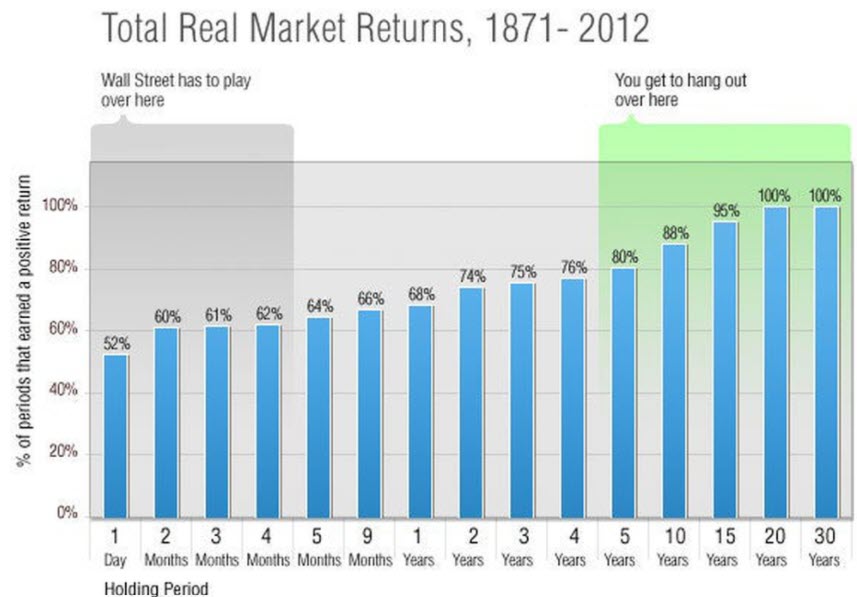

Short-term vs Long-term

In the short-term, the value of your stocks may change a lot, affecting your returns. But in the long-term, it’s the sales and profits of the companies you invested in that matter more.

Hold Onto Your Investments Longer

Increase your chance of success by keeping your investments for a longer time.

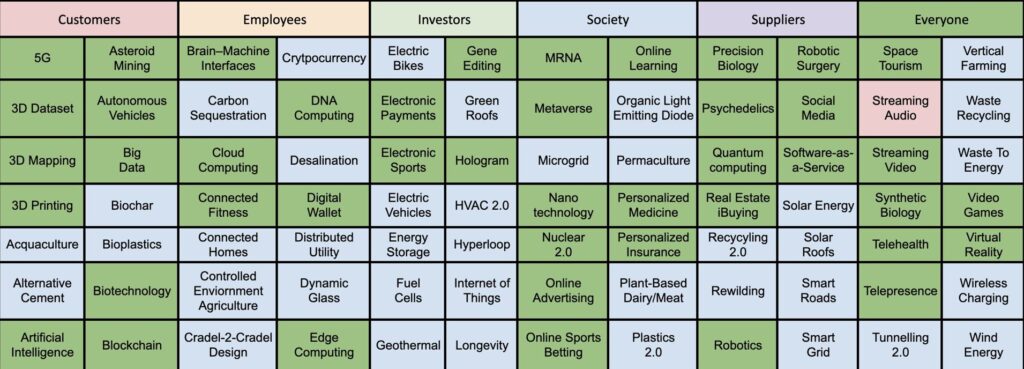

We Live in a Fast-Changing World

We are going through a time of big changes which can affect the market.

Stocks Win in the Long Run

Over a long time, investing in stocks usually turns out to be a winning choice.