The SEC Stabilization Act is a bill introduced by U.S. Representatives Tom Emmer (R-MN) and Warren Davidson (R-OH) on June 12, 2023. The bill would amend the Securities and Exchange Act of 1934 to create a new bipartisan structure for the Securities and Exchange Commission (SEC).

U.S. Representatives Warren Davidson (R-OH) said in a statement:

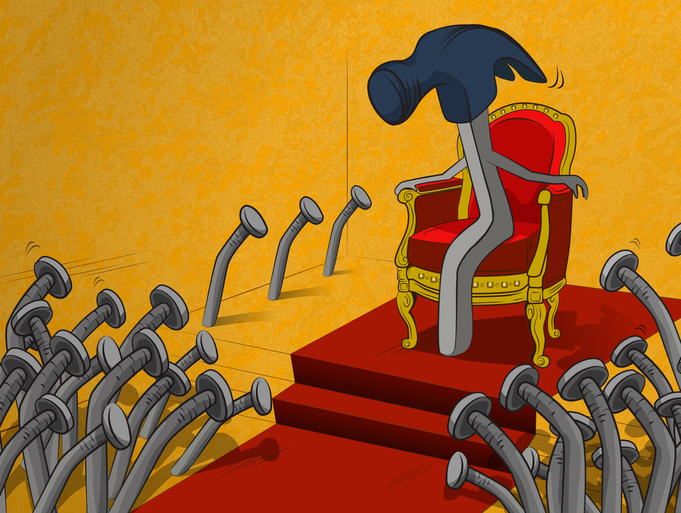

“U.S. capital markets must be protected from a tyrannical Chairman, including the current one. That’s why I’m introducing legislation to fix the ongoing abuse of power and ensure protection that is in the best interest of the market for years to come. It’s time for real reform and to fire Gary Gensler as Chair of the SEC.”

The bill would create a new bipartisan structure for the SEC. Under the current law, the SEC is composed of five commissioners, who are appointed by the President and confirmed by the Senate. However, the SEC Stabilization Act would require that no more than three commissioners can be appointed from the same political party. This would ensure that the SEC is never controlled by a single political party, and would force commissioners to work together in a bipartisan manner.

The bill would also make it more difficult for the SEC to adopt new rules. Under the current law, the SEC can adopt new rules by a simple majority vote of the commissioners. However, the SEC Stabilization Act would require a two-thirds majority vote to adopt new rules. This would make it more difficult for the SEC to adopt rules that are controversial or that have a significant impact on the financial markets.

The SEC Stabilization Act is a response to concerns that the SEC has become too politicized in recent years. The bill’s supporters argue that the current structure of the SEC allows a single party to control the agency and to use it to advance its own political agenda. They argue that the SEC Stabilization Act would create a more stable and predictable regulatory environment for the financial markets.

The SEC Stabilization Act has been met with mixed reactions. Some have praised the bill as a necessary step to protect the financial markets from political interference. Others have criticized the bill as an attempt to weaken the SEC and to make it more difficult for the agency to protect investors.

The SEC Stabilization Act is currently being considered by the U.S. House of Representatives. It is unclear whether the bill will be passed by the House or the Senate.

Here are some of the arguments in favor of the SEC Stabilization Act:

- The bill would create a more stable and predictable regulatory environment for the financial markets.

- The bill would make it more difficult for the SEC to be used to advance a single political party’s agenda.

- The bill would force the SEC to work more closely with Congress and with the financial industry.