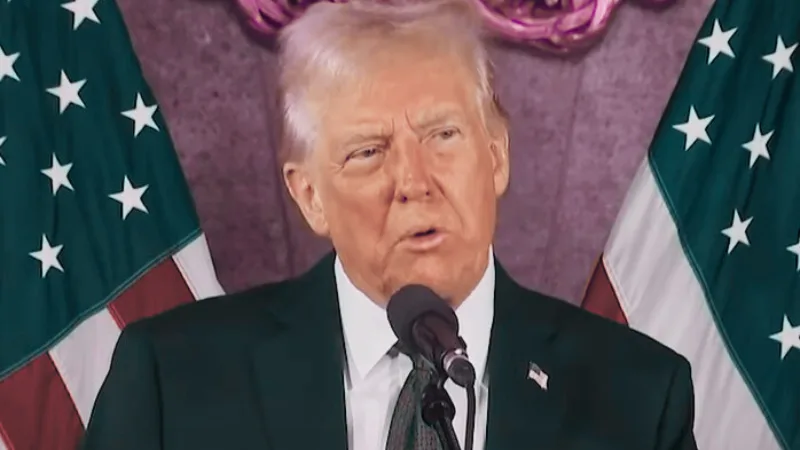

President Donald Trump has laid out a series of tax reform promises aimed at benefiting different groups of Americans. These proposals, if enacted, could have a significant impact on workers, retirees, business owners, and the broader economy. Below is a breakdown of each promise, including when it was made, any direct quotes from President Trump, its potential impact, and the likelihood of it becoming law.

No Tax on Tips

Date of Promise: September 2024

Quote: “We’re going to eliminate taxes on tips for our hardworking service industry employees.”

Impact: Removing taxes on tips would increase take-home pay for service industry workers, benefiting millions of employees in restaurants, hospitality, and other tip-based professions. However, critics argue this could lead to revenue losses for the federal government, estimated at $250 billion annually, and could incentivize wage manipulation to avoid taxes.

Likelihood of Fulfillment: While this proposal is popular among workers, it would require legislative approval and could face opposition due to concerns over revenue loss and tax fairness.

No Tax on Seniors’ Social Security

Date of Promise: October 2024

Quote: “We will end taxation on Social Security benefits for our great seniors.”

Impact: Eliminating taxes on Social Security would increase disposable income for retirees, particularly those with other sources of income. However, it would also reduce federal tax revenues, raising concerns about Social Security’s long-term funding.

Likelihood of Fulfillment: This would require changes to the tax code, and while it would be popular among seniors, it may face opposition from lawmakers worried about fiscal responsibility.

No Tax on Overtime Pay

Date of Promise: November 2024

Quote: “Overtime pay should be tax-free to reward those who work extra hours.”

Impact: This change would increase take-home pay for hourly and salaried employees who work beyond the standard 40-hour workweek. However, it could lead to revenue shortfalls and administrative complications for employers.

Likelihood of Fulfillment: This proposal would need congressional approval and may face resistance due to concerns about federal budget impacts.

Renew Trump’s Middle-Class Tax Cuts

Date of Promise: December 2024

Quote: “We will renew and expand our middle-class tax cuts to put more money in the pockets of hardworking Americans.”

Impact: Extending and expanding tax cuts would increase disposable income for middle-class families and potentially boost economic activity. However, estimates suggest it could add up to $6 trillion to the national deficit over ten years.

Likelihood of Fulfillment: Popular with voters, but fiscal concerns could make passage difficult.

Adjusting the SALT Cap

Date of Promise: January 2025

Quote: “We will adjust the SALT cap to provide relief to homeowners in high-tax states.”

Impact: Raising the cap on state and local tax (SALT) deductions would benefit residents in high-tax states like New York and California. However, it would primarily help higher-income taxpayers and could reduce federal revenue.

Likelihood of Fulfillment: This measure could face resistance from fiscal conservatives who view the cap as a necessary check on high-tax states.

Eliminate Special Tax Breaks for Billionaire Sports Team Owners

Date of Promise: February 2025

Quote: “It’s time to end the special tax breaks for billionaire sports team owners who have taken advantage of the system for too long.”

Impact: Removing these tax breaks could increase federal revenue and address concerns about tax system fairness. However, sports franchise owners and lobbyists are likely to fight this proposal.

Likelihood of Fulfillment: Strong opposition from powerful stakeholders makes this a difficult promise to fulfill.

Close the Carried Interest Tax Deduction Loophole

Date of Promise: February 2025

Quote: “We will finally close the carried interest loophole that benefits wealthy financiers.”

Impact: Closing this loophole would increase tax liabilities for private equity and hedge fund managers, bringing in additional revenue for the government. This reform has bipartisan support but has repeatedly failed due to lobbying pressure.

Likelihood of Fulfillment: While politically popular, strong resistance from Wall Street makes passage uncertain.

Tax Cut for “Made in America” Products

Date of Promise: February 2025

Quote: “We will provide tax cuts for products proudly stamped with ‘Made in America’ to boost domestic manufacturing.”

Impact: This incentive could encourage manufacturing within the U.S., boosting jobs and economic growth. However, it could also trigger trade tensions and be challenging to implement without loopholes.

Likelihood of Fulfillment: This proposal may face challenges related to trade agreements and enforcement, making implementation uncertain.

A Tough Road Ahead

President Trump’s tax proposals have the potential to significantly impact the U.S. economy, particularly workers, retirees, and business owners. While some measures enjoy broad political support, others may face strong opposition due to their fiscal impact or resistance from special interest groups. The success of these tax reforms will largely depend on political dynamics, congressional cooperation, and economic conditions in the coming years.