Recent market volatility has reignited concerns about a potential recession. Understanding what constitutes a recession, the reasons behind rising fears, and the implications for financial markets is crucial for investors and consumers alike. Cerity Partners

What Is a Recession?

A recession is a significant decline in economic activity that lasts for an extended period, typically visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. The National Bureau of Economic Research (NBER) defines it as “a significant decline in economic activity spread across the economy, lasting more than a few months.” International Monetary Fund

Why Are Recession Fears Rising Now?

Several factors have contributed to the growing anxiety about a potential recession:

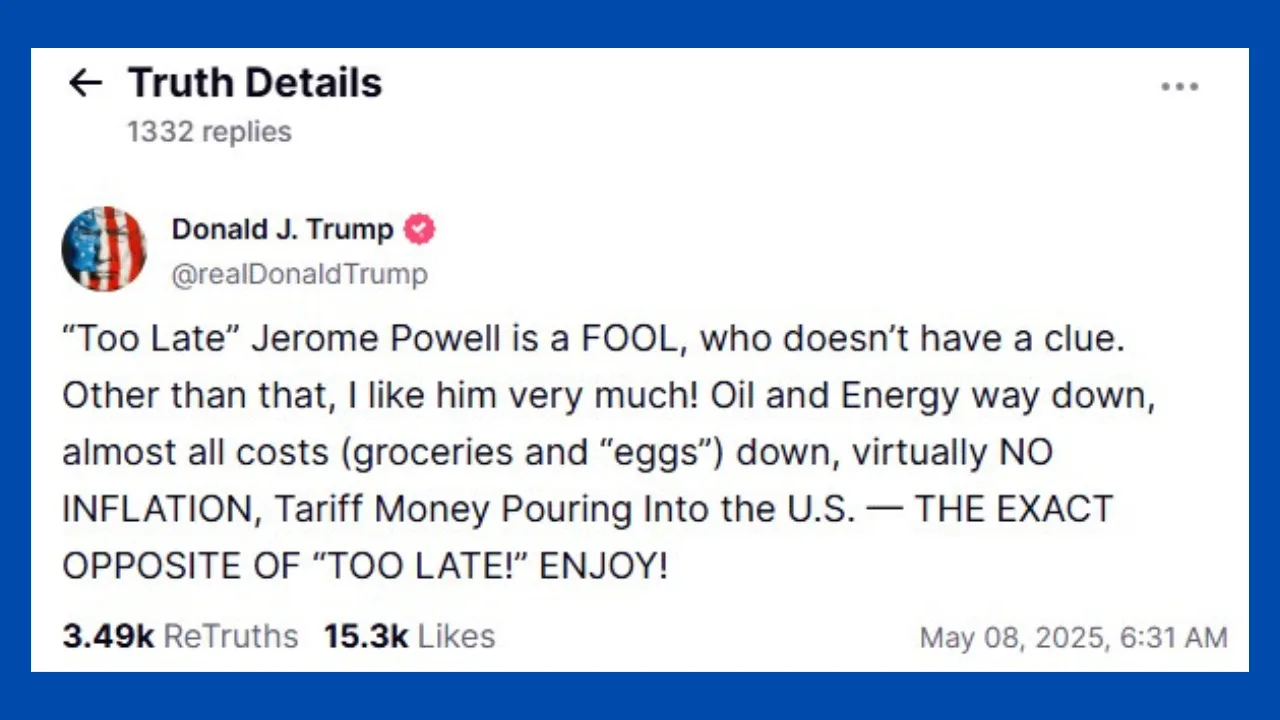

Trade Policies and Tariffs President Donald Trump’s aggressive trade policies, including substantial tariffs on imports from China, Mexico, and Canada, have led to retaliatory measures from these countries. This escalating trade war has resulted in significant stock market losses and declining consumer confidence.

Market Volatility The stock market has experienced sharp declines, with major indices like the Nasdaq entering correction territory and the S&P 500 nearing it. This downturn follows a period of optimism fueled by anticipated tax cuts and deregulation under President Trump. However, the recent implementation of aggressive tariffs has shifted the economic outlook.

Economic Indicators Key economic indicators, such as consumer sentiment, have shown signs of weakening. The University of Michigan’s consumer sentiment index fell to 57.9 in mid-March, marking its lowest level since November 2022. Factors undermining consumer confidence include economic policy uncertainty, declining stock prices, and worries of a potential recession.

How Is Market Anxiety Over a Recession Impacting Financial Markets?

The rising fear of a recession has had several notable effects on financial markets:

Stock Market Declines Major stock indices have suffered significant losses due to escalating trade tensions and uncertainty about future economic policies. The Dow Jones Industrial Average, for example, experienced substantial declines as investors reacted to the possibility of a global economic slowdown.

Bond Market Movements Investors seeking safer assets have turned to government bonds, leading to a decrease in yields. This flight to safety reflects concerns about economic growth and the potential for a recession.

Currency Fluctuations The U.S. dollar has experienced volatility as investors assess the impact of trade policies on the domestic economy. Uncertainty surrounding tariffs and their potential effects on global trade have contributed to currency market fluctuations.

Key Economic Indicators Signaling a Potential Recession

Monitoring specific economic indicators can provide insights into the likelihood of a recession:

Gross Domestic Product (GDP) Growth A slowdown in GDP growth or consecutive quarters of negative growth can signal a recession. Recent forecasts have downgraded GDP growth expectations due to escalating trade tensions.

Unemployment Rates Rising unemployment claims and job losses across various sectors can indicate economic distress. While current indicators show continued job growth, sustained increases in unemployment could signal a downturn.

Consumer and Business Sentiment Declining confidence among consumers and businesses can lead to reduced spending and investment, further slowing economic growth. The recent drop in consumer sentiment reflects growing concerns about economic stability.

How Are Policymakers and the Federal Reserve Responding?

Policymakers and the Federal Reserve play crucial roles in addressing recession fears:

Monetary Policy Adjustments The Federal Reserve may consider adjusting interest rates to stimulate economic activity. However, the current stance remains conservative, with rates held steady despite slowing growth and soft inflation.

Fiscal Policy Measures The government can implement fiscal policies, such as tax cuts or increased public spending, to boost economic activity. However, ongoing trade tensions and policy uncertainties have complicated the effectiveness of such measures.

What Can Investors and Consumers Do to Prepare?

Preparing for a potential recession involves several proactive steps:

- Diversify Investments Diversifying investment portfolios across various asset classes can help mitigate risks associated with market volatility. This strategy can provide a buffer against significant losses in any single sector.

- Maintain an Emergency Fund Building an emergency fund with sufficient savings to cover several months of expenses can provide financial security during economic downturns. This safety net is crucial in case of job loss or unexpected expenses.

- Review and Adjust Budgets Regularly reviewing and adjusting personal and business budgets can help identify areas to cut costs and improve financial resilience. Being proactive in managing expenses can alleviate stress during uncertain economic times.

- Stay Informed Keeping abreast of economic developments and understanding how they may impact personal finances or business operations is essential. Reliable sources of information can guide decision-making during volatile periods.