Bitcoin has done it again. On May 8, 2025, the world’s most valuable cryptocurrency smashed through the six-figure ceiling, climbing to an intraday high of $104,000. It’s the first time Bitcoin has traded above $100,000 since February, and the move has sent a clear signal to investors: the bulls are back.

This latest rally is more than just a psychological milestone. It’s a potential inflection point in a volatile year for crypto markets, which have been pulled between regulatory battles, macroeconomic uncertainty, and accelerating institutional adoption.

In this article, we’ll explore:

- The key drivers behind Bitcoin’s breakout

- Bullish and bearish scenarios in the near term

- Technical and psychological levels investors need to watch

- What experts and analysts are saying

Bitcoin Hits $100,000: What’s Fueling the Rally?

1. Trade Diplomacy and Market Confidence

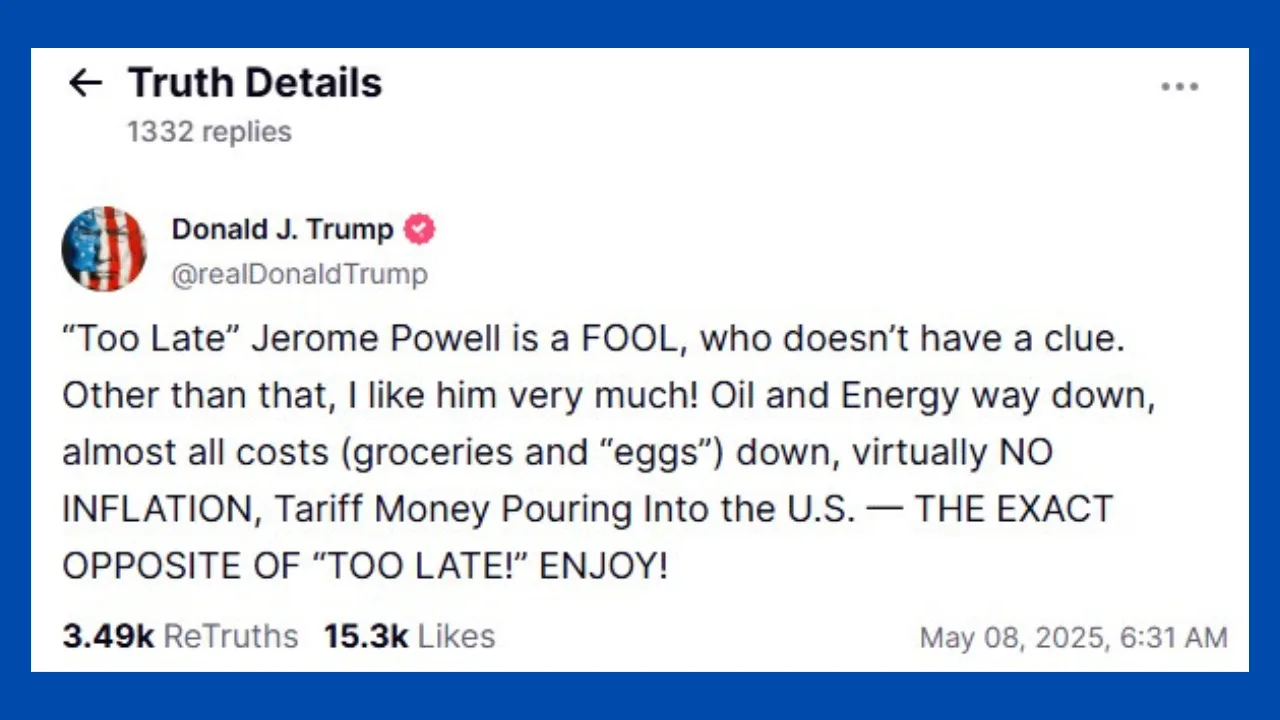

Bitcoin’s recent surge is closely linked to broader geopolitical and economic developments. President Donald Trump’s announcement of a new U.S.-U.K. trade deal has been interpreted by markets as a sign of de-escalation in global trade tensions.

“Global investors are recalibrating their expectations,” said Lindsey Bell, Chief Markets Strategist at Ally Invest. “The reduction in uncertainty and the reestablishment of international trade partnerships have opened the door for risk-on sentiment — and Bitcoin is clearly benefiting.”

2. Institutional Inflows from Spot Bitcoin ETFs

Perhaps the most significant tailwind has come from massive institutional buying via newly approved spot Bitcoin ETFs.

According to data from Glassnode, over $5.3 billion has flowed into Bitcoin ETFs over the past three weeks, led by BlackRock’s iShares Bitcoin Trust (IBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC).

Michael Saylor, Executive Chairman of MicroStrategy, recently confirmed that his firm added another 12,000 BTC in late April. “Bitcoin is digital property,” Saylor said in a Bloomberg interview. “It’s the apex asset in an inflationary world. Institutional demand is just getting started.”

3. Bitcoin Market Dominance Rising

Bitcoin dominance — the measure of BTC’s market cap relative to the rest of the crypto market — has surged past 60%, a level not seen since 2021. This suggests capital is consolidating into Bitcoin rather than being spread across altcoins.

“The Bitcoin dominance breakout confirms what we’re seeing on-chain: investors want safety, liquidity, and trust,” said James Butterfill, Head of Research at CoinShares. “Bitcoin is the flight-to-quality asset in crypto.”

Bullish Scenario: $120K+ in Sight?

With $100K reclaimed, analysts are eyeing $120K as the next major target — possibly within the next 4 to 12 weeks.

Key Bullish Catalysts:

- Continued institutional inflows into ETFs

- U.S. rate cuts (expected in June or July per CME FedWatch)

- Global macro stabilization (e.g., U.S.-China trade progress, stronger labor market)

- Positive momentum across tech and risk assets

Technical analysis supports the thesis. “A confirmed breakout above $104K could set up a move to $110K, then $120K, with Fibonacci extensions placing a long-term target closer to $135K,” said Katie Stockton, Managing Partner at Fairlead Strategies.

Investor Sentiment: Retail interest is returning. Coinbase reported a 28% surge in new user signups over the past week. Robinhood also saw a 41% increase in BTC trading volume.

FOMO (fear of missing out) is real. On Twitter/X, “#Bitcoin100K” trended globally, with influencers and analysts speculating about an incoming parabolic leg.

Bearish Risks: Could Bitcoin Fall Back to $90K?

Despite the bullish excitement, seasoned investors are warning of near-term pullbacks.

Potential Bearish Factors:

- Profit-taking from miners and long-term holders

- Overbought technical indicators (RSI near 78)

- Regulatory risk (e.g., renewed SEC pressure on crypto exchanges)

- Geopolitical tensions (e.g., flare-ups in the Taiwan Strait or Middle East)

“There’s nothing magical about $100K other than the optics,” said Noelle Acheson, author of Crypto is Macro Now. “We could easily see a correction to $92K or even $85K if the next CPI print surprises to the upside or if ETF inflows pause.”

Technical support zones are clustered around $90K–$92K and again at $85K. A breakdown below those could trigger stop-loss cascades and a quick fall to the mid-$70K range.

Technical Levels to Watch

Here are the most important technical and psychological zones investors should monitor in the coming weeks:

| Level | Meaning |

|---|---|

| $100K | Psychological support level |

| $104K–$107K | Immediate resistance zone |

| $120K | Bullish target if breakout sustains |

| $90K–$92K | Strong support from previous range |

| $85K | Last-ditch support before major drop |

Expert Outlook

Goldman Sachs released a client note suggesting Bitcoin could reach $125,000 by Q3 if ETF momentum continues and inflation data remains under control.

Cathie Wood of ARK Invest reiterated her long-term target of $1 million per BTC by 2030, noting that “institutional adoption is happening faster than anyone projected in 2020.”

Meanwhile, JPMorgan strategist Nikolaos Panigirtzoglou warned: “The rapid price appreciation could invite unwelcome regulatory scrutiny, especially if retail losses mount during a correction.”

What Investors Should Do

Short-Term Traders:

- Consider using tight stop-losses around $97K–$98K

- Watch ETF inflows and macroeconomic calendar (CPI, Fed meetings)

- Look for consolidation above $104K as bullish continuation signal

Long-Term Holders:

- Zoom out: Bitcoin is still below inflation-adjusted all-time highs

- Dollar-cost averaging remains a sound strategy

- Consider tax-loss harvesting if selling altcoin underperformers

Risk Management Tip: Don’t let headlines dictate your position size. Whether you’re bullish or bearish, keep position sizes reasonable and stay diversified.

Final Thoughts

Bitcoin crossing $100K again is not just a market event—it’s a sentiment shift. With institutions stepping in, macro headwinds easing, and ETF demand growing, the next few months could define Bitcoin’s 2025 trajectory.

Still, volatility is the norm, not the exception. For now, Bitcoin is king again. But the crown is heavy, and the road to $120K will test both resolve and risk management.

Sources:

- Reuters: Bitcoin Reclaims $100K on Trade Deal Optimism

- Business Insider: Bitcoin Hits $104,000

- Glassnode: On-Chain ETF Inflows Tracker