Boeing Co. (NYSE: BA) is experiencing a significant resurgence, buoyed by a series of favorable developments in international trade and substantial aircraft orders. These events are reshaping the company’s trajectory and offering fresh opportunities for investors.

China Lifts Ban on Boeing Deliveries Amid Trade Truce

In a pivotal move, China has lifted its month-long ban on Boeing aircraft deliveries following a 90-day trade truce with the United States. This agreement reduces U.S. tariffs on Chinese goods from 145% to 30%, while China’s tariffs on U.S. products, including Boeing jets, drop from 125% to 10%.

The ban had previously halted deliveries of Boeing’s 737 Max aircraft to China, a market that accounted for a fifth of the company’s annual deliveries. With the ban lifted, Boeing aims to fulfill its expected 50 jet deliveries to Chinese customers this year. New York Post

This development is crucial for Boeing, as China is projected to require nearly 9,000 new planes over the next two decades, representing about 450 annually.

Saudi Arabia’s AviLease Places First Direct Boeing Order

In another significant development, Saudi Arabia’s AviLease, a firm owned by the country’s sovereign wealth fund, has placed its first direct order with Boeing for up to 30 737 MAX jets. The order includes a firm purchase of 20 737-8 aircraft with options for 10 more. Reuters

This order aligns with Saudi Arabia’s strategic plan to transform the country into a global aviation hub, aiming to serve 330 million passengers and attract 150 million visitors annually by 2030.

British Airways’ Parent Company Orders 32 Boeing 787 Dreamliners

British Airways’ parent company, International Airlines Group (IAG), has confirmed an order for 32 Boeing 787-10 aircraft equipped with General Electric engines. This $10 billion deal comes after a recent U.S.-U.K. trade agreement that eliminates tariffs on aircraft parts.

The new aircraft will primarily replace existing planes, with deliveries scheduled between 2028 and 2033. This move is part of IAG’s strategy to modernize its fleet and expand its long-haul operations. Charleston Business Magazine

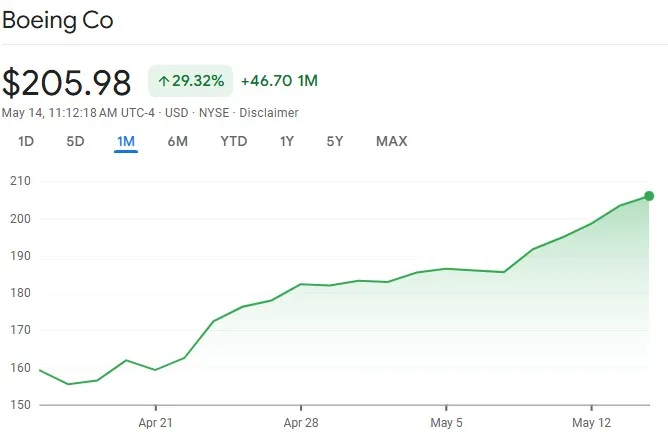

Boeing Stock Performance and Investor Outlook

These positive developments have had a tangible impact on Boeing’s stock performance. Shares surged 2.8% to $204.04, hitting a 52-week high, and are up over 15% this month. The company’s substantial backlog of nearly 6,300 jets as of April 30 provides a solid foundation for future growth. Investor’s

Investment Considerations

- Market Expansion: The resumption of deliveries to China and new orders from Saudi Arabia and the U.K. signal a robust demand for Boeing’s aircraft, indicating potential revenue growth.

- Trade Relations: The easing of trade tensions with major markets like China and the U.K. reduces uncertainty and opens avenues for increased sales.

- Fleet Modernization: Airlines’ focus on upgrading their fleets with fuel-efficient aircraft like the 737 MAX and 787 Dreamliner positions Boeing favorably in the market.

- Stock Valuation: With the stock hitting new highs, investors should assess valuation metrics and consider potential risks, including production challenges and geopolitical factors.

Conclusion

Boeing’s recent successes in lifting trade restrictions and securing significant aircraft orders underscore the company’s resilience and strategic positioning in the global aerospace industry. For investors, these developments present a compelling case for considering Boeing stock as a potential addition to their portfolios, keeping in mind the importance of ongoing due diligence and market analysis.