US Congressman Warren Davidson has emerged as a prominent critic of central bank digital currencies (CBDCs), voicing concerns about potential government control and the erosion of individual freedoms. In March 2023, Davidson urged his fellow House colleagues to prevent state-led efforts to facilitate CBDCs, arguing that such currencies could eliminate the privacy and freedom inherent in cash transactions, granting the government unprecedented power over citizens’ lives.

To reinforce his stance, Davidson introduced the Keep Your Coins Act in April 2023, a legislative proposal aimed at prohibiting the Federal Reserve from issuing a CBDC. The bill found support from six other Republican members of Congress who share similar reservations.

In May 2023, Davidson testified before the House Financial Services Committee, highlighting the dangers associated with CBDCs. His testimony revolved around two major concerns: the potential undermining of the dollar’s status as the world’s reserve currency and the creation of a new surveillance tool for the government.

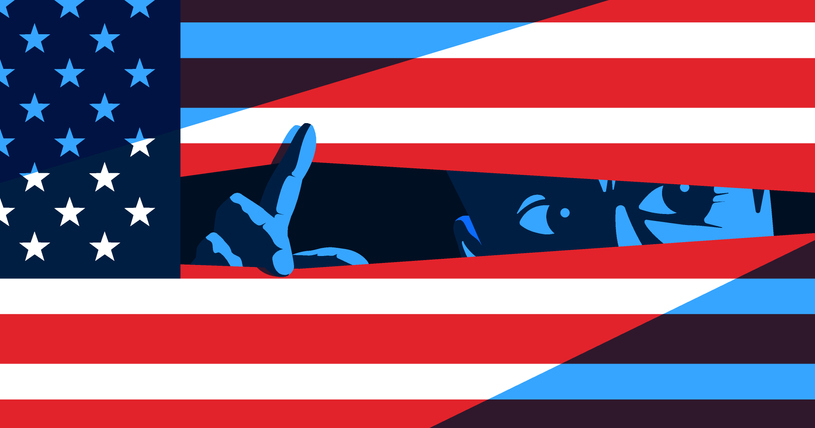

The first major concern is the threat to individual privacy. Davidson argues that since CBDCs would be digital, every transaction made using them could be easily tracked by the government, leading to detailed records of individuals’ financial activities. Such a level of surveillance could open the door to targeted monitoring and potential prosecution based on citizens’ financial behaviors.

The second concern revolves around the erosion of individual freedom. If the government issues a CBDC, it could impose restrictions on how and where these digital currencies can be used. This could extend to limiting certain types of transactions, such as political donations or the purchase of specific goods and services, effectively controlling the choices citizens make with their money.

Additionally, there is a worry that the introduction of a CBDC might undermine the dollar’s status as the world’s primary reserve currency. Currently, the US dollar is widely accepted and trusted globally for international trade and investments due to its stability. However, the introduction of an untested CBDC might lead other countries to be hesitant in adopting it, potentially diminishing the dollar’s value on the international stage.

Another concern highlighted by Davidson is the potential increase in the cost of payments associated with CBDCs. The transition to a digital currency would necessitate the development of new infrastructure and systems, leading to higher costs for businesses and consumers alike.

It is essential to acknowledge that these concerns are not without merit, and they reflect the skepticism many individuals hold regarding government control. Nevertheless, it is worth noting that CBDCs also come with potential benefits, such as promoting financial inclusion and reducing payment costs. As the Federal Reserve continues its research on CBDCs, the ultimate decision on whether to issue a CBDC will need to carefully weigh both the risks and the rewards.

In conclusion, the debate over CBDCs represents a significant crossroads in the financial world, with critical implications for individual privacy, freedom, and the overall control of financial systems. While some applaud Congressman Davidson’s efforts to safeguard these fundamental rights, others argue that CBDCs could offer promising solutions to various financial challenges. As developments continue, it is crucial for individuals to remain informed and vigilant about the potential consequences of these emerging digital currencies.