The proposed acquisition of U.S. Steel by Nippon Steel, Japan’s largest steelmaker, has ignited a political firestorm in the United States. At the forefront of the opposition is former President Donald Trump, who has vowed to block the $15 billion deal, citing concerns about national security, American jobs, and economic sovereignty. As the debate unfolds, it raises critical questions about how such a deal could affect everyday Americans and their personal finances.

A Brief History of the Deal

In late 2023, Nippon Steel announced plans to acquire U.S. Steel, one of America’s most iconic industrial companies, in a bid to strengthen its global footprint. The deal, valued at approximately $15 billion, promised substantial investments in U.S. operations and commitments to preserve union jobs.

Despite these assurances, the proposal has faced significant backlash. Both the Biden administration and Donald Trump have expressed concerns, pointing to potential national security risks and the loss of control over a key strategic industry. The Committee on Foreign Investment in the United States (CFIUS) is currently reviewing the deal to assess its implications, but Trump has been particularly vocal in his opposition.

Donald Trump’s Involvement and Stance

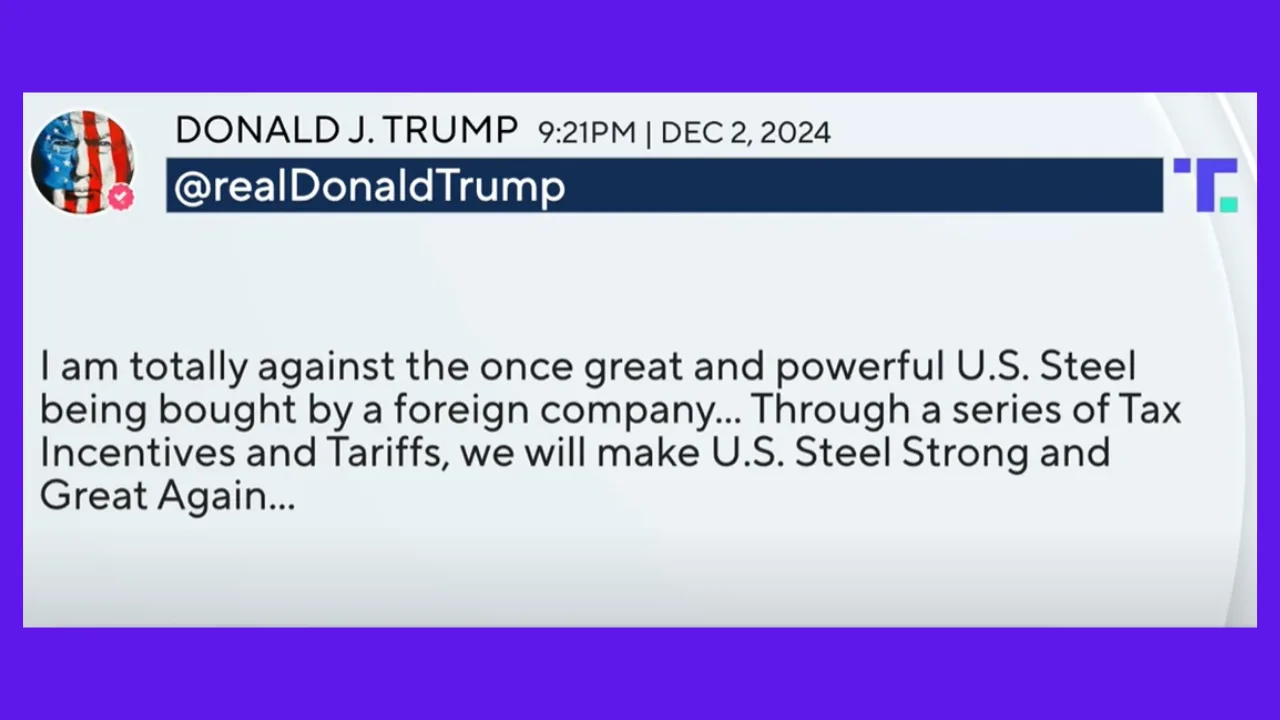

Trump’s stance on the deal is consistent with his “America First” economic policies, which prioritize domestic manufacturing and economic independence. In February 2024, while on the campaign trail, Trump declared his intention to “block [the deal] instantaneously” if reelected. Following his return to the presidency, Trump reiterated his opposition, stating on December 2, 2024, that he would “not allow the once-great U.S. Steel to fall into foreign hands.”

Trump has proposed using tax incentives and tariffs to strengthen U.S. Steel and make foreign acquisitions less attractive. He argues that allowing Nippon Steel to acquire the company would jeopardize national security, undermine American workers, and diminish the country’s industrial strength.

Impact on the Common American

While corporate mergers and acquisitions might seem distant from the concerns of everyday Americans, this deal could have tangible effects on personal finances, job security, and economic stability.

- Job Security:

U.S. Steel employs thousands of workers across the country, many of whom are members of labor unions. While Nippon Steel has pledged to maintain these jobs, foreign acquisitions often lead to restructuring, which could eventually impact employment. - National Security and Economic Sovereignty:

Steel is a critical industry for defense and infrastructure. A foreign-owned U.S. Steel could raise concerns about the security of supply chains, particularly during geopolitical tensions. - Consumer Prices:

Changes in steel production costs could ripple through the economy, potentially raising prices for products like cars, appliances, and construction materials. - Community Impact:

Many local economies rely heavily on U.S. Steel facilities. Any changes in operations or management priorities could affect the livelihoods of thousands of families and the small businesses that support these communities.

Why This Matters to You

The fight over U.S. Steel’s future is more than a political or corporate issue—it’s about the broader implications of foreign ownership in critical industries. Trump’s opposition to the deal underscores his broader economic vision, one that aims to keep American jobs and industries under domestic control. For the average American, the outcome of this debate could influence job opportunities, local economies, and even the cost of everyday goods.

Conclusion:

As the CFIUS review continues and Trump ramps up his opposition, the future of U.S. Steel hangs in the balance. Whether the deal moves forward or is blocked, it serves as a stark reminder of the intersection between global business and national interests. For now, Americans will be watching closely, knowing that the outcome could have lasting effects on their wallets and the nation’s economic independence.