In a significant blow to Google’s business operations, a federal judge ruled Thursday that the tech giant’s advertising practices constitute an illegal monopoly. This ruling has profound implications not only for Google but also for the broader digital advertising industry and investors holding stakes in Alphabet (NASDAQ: GOOGL).

U.S. District Judge Leonie Brinkema determined that Google’s monopoly in the online ad exchange and ad server markets breached the Sherman Antitrust Act. This landmark ruling underscores persistent regulatory scrutiny faced by the largest technology companies, potentially leading to drastic structural changes within Google’s advertising segment, a core revenue driver for Alphabet.

Details of the Landmark Ruling

Judge Brinkema’s ruling focused specifically on Google’s control over online advertising exchanges and servers, tools integral to how publishers sell ads on websites and how advertisers purchase ad spaces. The judge clearly outlined in her written decision that Google unlawfully tied one service to another, essentially forcing customers to buy bundled advertising services that limited competitors’ access to the market.

The ruling explicitly stated, “In addition to depriving rivals of the ability to compete, this exclusionary conduct substantially harmed Google’s publisher customers, the competitive process, and ultimately, consumers of information on the open web.”

The Justice Department, however, did not win every aspect of its antitrust claims. Brinkema rejected allegations that Google unlawfully monopolized the market for services that assist advertisers in buying display ads on various platforms. Nonetheless, the overall decision remains a substantial legal setback for Google.

Google’s Response and Next Steps

Alphabet has already signaled its intent to challenge parts of the ruling. Lee-Anne Mulholland, a Vice President at Google, publicly disagreed with the judge’s conclusions regarding the company’s publisher tools, emphasizing that Google believes its advertising tools offer substantial value to publishers. “We disagree with the Court’s decision regarding our publisher tools. Publishers have many options, and they choose Google because our ad tech tools are simple, affordable, and effective,” Mulholland said.

This appeal process is anticipated to be lengthy and complex, potentially extending over multiple years. Alphabet has previously shown its willingness and capacity to engage in protracted legal battles, as evidenced by earlier cases.

Broader Antitrust Challenges in Big Tech

This case against Google is part of a broader wave of antitrust actions targeting tech giants. Under President Trump’s administration, the Justice Department has maintained and intensified antitrust scrutiny initiated by previous administrations. Similar high-profile cases are simultaneously underway involving other tech industry leaders:

- Meta Platforms (formerly Facebook): Facing a Federal Trade Commission (FTC) trial, CEO Mark Zuckerberg recently testified extensively in a case aiming to force the divestiture of Instagram and WhatsApp.

- Amazon: Accused by the FTC of monopolistic practices within e-commerce. Amazon has successfully dismissed parts of the case and continues vigorously contesting the charges.

- Apple: Under scrutiny for allegedly restricting external software integration, thus locking users into its ecosystem. Apple continues to contest these allegations in court, emphasizing the lack of tangible consumer harm demonstrated by regulators.

In August, another federal ruling by U.S. District Judge Amit Mehta found Google’s search engine dominance also violates antitrust law. These overlapping cases compound legal pressures on Alphabet, raising the stakes significantly for the company.

Potential Remedies and Market Impact

Looking forward, both Judges Brinkema and Mehta will be tasked with determining remedies to Google’s monopolistic behavior. The Department of Justice previously suggested divesting specific business units as potential solutions, notably advocating Google’s separation from its popular Chrome browser and possibly parts of its lucrative advertising technology platforms, including AdX, which generated approximately $31 billion in revenue in 2023—around one-tenth of Alphabet’s total annual sales.

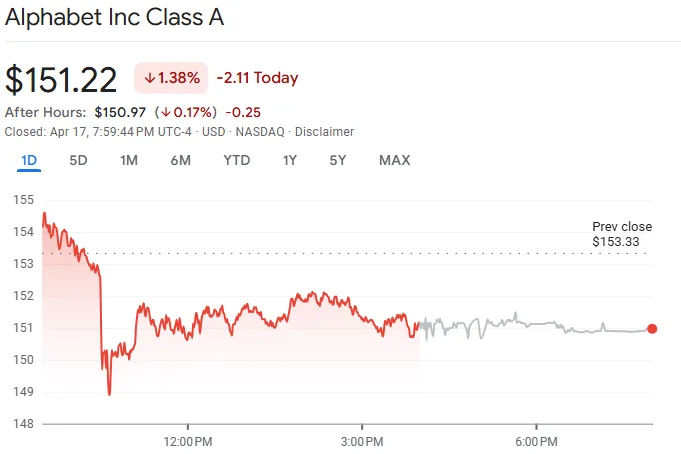

This potential restructuring carries significant implications for investors. A forced divestiture could materially impact Alphabet’s revenue streams, valuation, and market position. On the day of Brinkema’s ruling, Alphabet shares declined 1.4%, reflecting investor apprehension over the potential disruption to Google’s advertising empire.

Industry Perspectives on Google’s Practices

Throughout the trial, testimonies from leading media executives, including representatives from prominent publishers such as Gannett, News Corp, and the Daily Mail, illustrated industry-wide concerns. These media outlets indicated frustration with Google’s dominance, suggesting that even companies wishing to move away from Google’s AdX service find themselves trapped due to limited viable alternatives.

Notably, a 2018 internal Google email revealed during the trial provided a damning perspective on Google’s market power. Former Google executive Chris LaSala expressed internal concerns, stating the company was “extracting irrationally high rent” from customers using AdX, taking as much as a 20% cut from advertising transactions. LaSala noted, “I don’t think there is 20% of value in comparing two bids,” highlighting internal recognition of potentially exploitative practices.

Implications for Investors: Opportunities and Risks

Investors must carefully weigh the implications of this ruling. Alphabet shareholders face immediate uncertainty, and the prospect of enforced divestitures may require reconsideration of the company’s valuation models. Long-term investors should prepare for ongoing volatility as the appeals process unfolds, potentially affecting Google’s core advertising revenue streams significantly.

Conversely, opportunities may arise within the broader ad tech sector. If Google is compelled to divest parts of its business, smaller competitors might experience considerable market share growth, creating attractive investment opportunities in firms poised to capitalize on the restructured landscape. Companies like Magnite (NASDAQ: MGNI) and The Trade Desk (NASDAQ: TTD), which compete directly in advertising exchanges and servers, could stand to benefit substantially.

Additionally, publishers and advertisers may gain negotiating leverage if Google’s market power diminishes, potentially improving profit margins and market flexibility for other publicly traded digital advertising firms and publishers.

Navigating a Shifting Ad-Tech Landscape

The judicial decision marking Google as operating an illegal monopoly is a critical juncture not just for Alphabet but for the entire digital advertising ecosystem. Investors should closely monitor ongoing developments, including Alphabet’s appeals process, regulatory remedies, and industry responses.

This ruling serves as an important reminder of regulatory risks inherent in tech sector investments. Investors are advised to diversify holdings, carefully evaluate exposure to regulatory risks, and watch for potential market shifts benefiting alternative advertising technology companies.

Understanding these dynamics will enable investors to navigate the volatile but potentially rewarding period ahead in digital advertising and big tech investments.