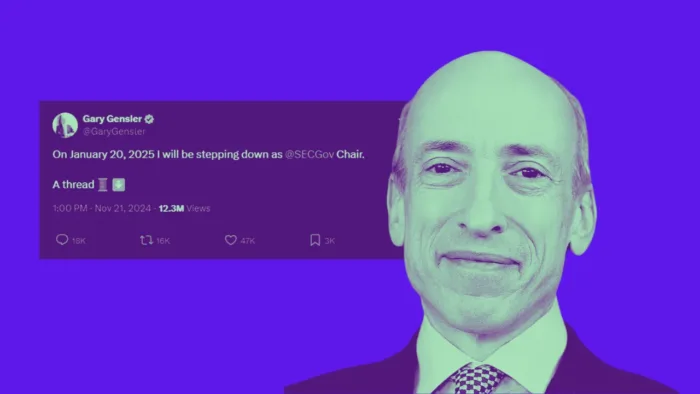

The financial world is buzzing with the news: Gary Gensler, Chair of the U.S. Securities and Exchange Commission (SEC), will resign on January 20, 2025, aligning with the inauguration of President-elect Donald Trump. This departure signals a potential shift in the regulatory landscape, one that could have significant implications for your investments, whether in stocks, cryptocurrency, or beyond.

Why Is Gensler Resigning?

Gensler’s resignation aligns with a long-standing tradition of SEC chairs stepping down with the arrival of a new administration. Appointed by President Biden in 2021, Gensler became known for his aggressive regulatory approach, particularly toward cryptocurrencies. His tenure saw high-profile enforcement actions against major exchanges like Binance and Coinbase, reflecting his view that the crypto sector is rife with fraud and unregistered securities.

With Trump’s election, the incoming administration is expected to appoint a new SEC chair with a more lenient regulatory stance, potentially reversing some of Gensler’s policies.

What Does This Mean for You?

For individual investors, Gensler’s resignation could have a mixed impact:

- Less Regulation, More Risk: A more business-friendly SEC may lead to fewer regulatory hurdles, potentially spurring innovation and market growth. However, reduced oversight could increase the risks of fraud and market volatility.

- Opportunities in Crypto: For those invested in cryptocurrencies, Gensler’s departure is seen as a green light. Bitcoin has already surged toward $100,000, fueled by optimism about a more favorable regulatory environment.

- Shifts in Stock Market Dynamics: With expectations of deregulation under the Trump administration, industries like finance, oil, and technology could see gains. But investors should remain cautious, as reduced regulation can sometimes lead to overheated markets.

How Will This Impact the Stock Market?

Wall Street is already reacting positively to Trump’s win and the anticipated regulatory changes. Major indexes have hit record highs, reflecting investor optimism about deregulation, tax cuts, and pro-business policies.

Expect significant growth in sectors like:

- Finance: Reduced regulatory scrutiny could lower compliance costs and boost profitability for financial institutions.

- Energy: Trump’s policies are likely to favor traditional energy sectors, particularly oil and gas, driving further investment.

- Technology: The tech sector, particularly fintech and blockchain companies, may thrive under a more relaxed regulatory framework.

What’s Next for Cryptocurrency?

Cryptocurrency investors have arguably the most to gain. Gensler’s strict approach to regulating digital assets created significant barriers for the industry. With his departure, there’s growing anticipation that the SEC will adopt a softer stance, encouraging broader adoption and investment in digital assets.

Bitcoin’s rally to nearly $100,000 reflects this sentiment, and other cryptocurrencies may follow suit. However, the lack of stringent oversight could also lead to heightened market risks, making it crucial for investors to conduct thorough due diligence.

The Bigger Picture

Gensler’s resignation is more than a personnel change—it’s a turning point for markets. As the regulatory pendulum swings, investors must stay vigilant, adapting their strategies to navigate both opportunities and risks.

At Global Market News, we’ll keep you updated on how these changes unfold and what they mean for your portfolio. Subscribe to our newsletter for real-time insights and actionable advice to stay ahead of the curve.