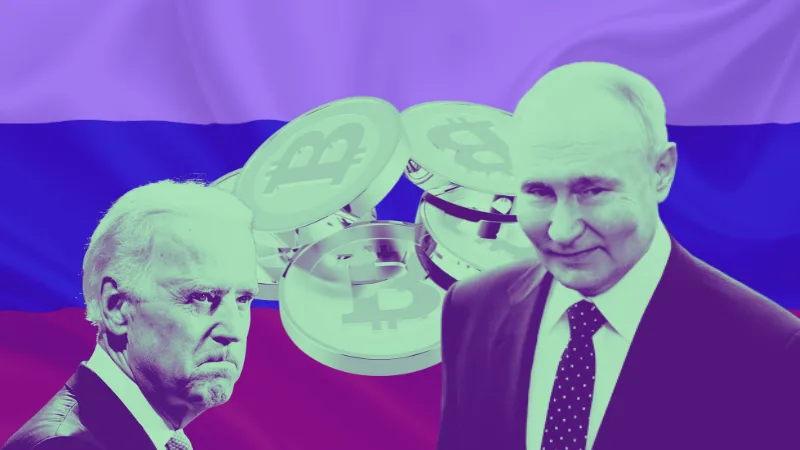

In the face of mounting Western sanctions, Russia has turned to an unlikely ally: Bitcoin. This move signals a significant shift in global economic strategy and raises critical questions about the future of international trade and the role of cryptocurrencies in geopolitics. This article explores the factors behind Russia’s pivot to Bitcoin, its implications, and the challenges it poses to the global financial system.

The Background: Why Russia Turned to Bitcoin

Since the invasion of Ukraine in 2022, Russia has faced escalating economic sanctions from Western nations. These sanctions have targeted critical sectors of its economy, including energy exports, banking, and access to international financial systems. As a result, Russia’s ability to engage in global trade has been significantly curtailed.

In response, the Russian government has sought alternative methods to sustain its economy. One such method is the use of Bitcoin and other cryptocurrencies for international trade. Unlike traditional financial systems, cryptocurrencies operate on decentralized blockchain networks, making them resistant to government control and less susceptible to sanctions.

Legislative Changes Enabling Bitcoin Adoption

To facilitate the use of cryptocurrencies, Russia enacted legislative reforms in 2024. These laws legalized cryptocurrency mining and allowed businesses to use digital assets for cross-border transactions. The Central Bank of Russia (CBR) established an experimental regime to regulate and oversee these activities. This framework provides select companies with the ability to mine Bitcoin domestically and use it for international trade.

Finance Minister Anton Siluanov recently confirmed that Russian businesses have started conducting cross-border payments using Bitcoin. He emphasized that this is part of an experimental stage but expressed optimism about its potential to grow in scale over the coming years.

How Bitcoin Transactions Work for Sanctions Evasion

Bitcoin transactions operate on a decentralized blockchain, enabling peer-to-peer exchanges without the need for intermediaries like banks. This decentralized nature allows Russia to bypass traditional financial systems and execute trades directly with international partners. Here’s how the process typically works:

- Mining Bitcoin Domestically: Authorized entities mine Bitcoin within Russia’s borders, creating a domestic supply of the cryptocurrency.

- Trading Bitcoin for Goods: The mined Bitcoin is used to pay international suppliers or trade partners.

- Converting Bitcoin: In some cases, foreign trade partners convert the received Bitcoin into local currencies or use it for their own purposes.

The Global Implications of Russia’s Strategy

Russia’s use of Bitcoin for international trade has significant implications for global finance:

- Challenges to Sanctions Enforcement: Cryptocurrencies’ decentralized nature complicates efforts to monitor and enforce sanctions. Traditional mechanisms, such as freezing bank accounts or restricting SWIFT access, are ineffective in the cryptocurrency realm.

- Erosion of Dollar Dominance: Russia’s shift away from the U.S. dollar aligns with President Vladimir Putin’s criticism of the dollar’s dominance. This move could inspire other nations to explore cryptocurrencies as alternatives to dollar-based trade.

- Emerging Markets Adoption: Russia’s actions may encourage emerging markets to adopt similar strategies, potentially accelerating the global adoption of cryptocurrencies in international trade.

Challenges and Limitations

While Russia’s strategy demonstrates the potential of cryptocurrencies, it also highlights their limitations:

- Market Volatility: Bitcoin’s price volatility makes it a risky medium for trade. Sudden price fluctuations can impact the value of transactions.

- Liquidity Issues: The cryptocurrency market’s limited liquidity compared to traditional financial systems may restrict large-scale transactions.

- Regulatory Risks: Countries opposed to Russia’s actions may impose stricter regulations on cryptocurrency exchanges, making it harder for Russia to use Bitcoin effectively.

Expert Opinions on Russia’s Bitcoin Strategy

Many financial analysts are skeptical about the long-term viability of Russia’s reliance on Bitcoin. “Cryptocurrencies are a double-edged sword for governments under sanctions. They provide a lifeline, but adoption on a meaningful scale remains a challenge due to regulatory hurdles and liquidity constraints,” says Dr. Garrick Hileman, former Head of Research at Blockchain.com

Others argue that Russia’s actions underscore the need for a more decentralized global financial system. “The use of cryptocurrencies by sanctioned states like Russia exposes gaps in our current global financial systems and underscores the urgency for more robust governance frameworks,” says Alex Zerden, former Treasury official and fintech expert.

A New Chapter in Economic Warfare

Russia’s adoption of Bitcoin for international trade marks a new chapter in the intersection of technology and geopolitics. While it offers a glimpse into the potential of cryptocurrencies to disrupt traditional systems, it also raises complex challenges for global governance and economic stability.

As the world watches this experiment unfold, one thing is clear: the role of cryptocurrencies in international trade and geopolitics is set to grow, reshaping the landscape of global finance in the years to come.