Today marks a historic moment as the S&P 500 kicks off the trading day north of the 5,000-point threshold for the first time. This isn’t just a number. The 5,000-point milestone is a testament to the robustness of the US economy, which continues to flourish amidst rising interest rates, defying conventional wisdom.

The Significance of 5,000

Why does crossing 5,000 matter? Beyond the quirky fact that “five thousand” is a phrase uniquely composed of non-repeating letters, it symbolizes the collective optimism of investors in the enduring strength of the US economy. The journey to this point has been nothing short of spectacular, with a 20% climb since the early days of November. Doubling in value since September 2017, when it hovered around 2,500, the S&P 500’s performance is a clear indicator of the market’s bullish trend.

The Impact on Your Investments

Chances are, your stock portfolio is looking healthier than ever. As the world’s most closely monitored index, the S&P 500 influences approximately $11.4 trillion in passive investments and funds benchmarked against it, according to S&P Global’s 2022 data.

The Drivers of the Rally: AI and Tech Giants

While the S&P 500 encompasses a diverse range of 500 companies, the real movers and shakers are a handful of tech giants, often referred to as the “Magnificent Seven.” This elite group, featuring powerhouses like Meta, Microsoft, and Nvidia, makes up 29% of the index’s total weight. Their dominance in the market has grown as bets on their leading role in the AI revolution intensify.

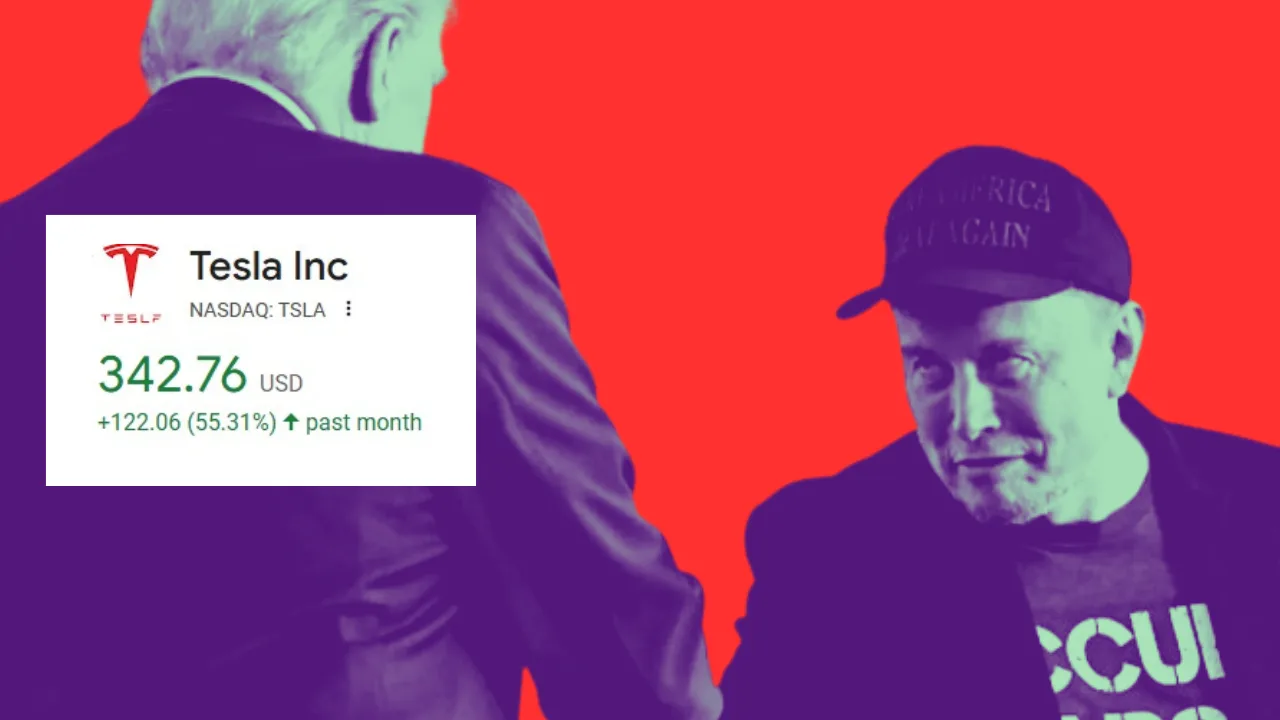

Tesla’s Place Among the Elite

However, there’s growing debate over whether Tesla should retain its spot in this prestigious group. The electric vehicle giant has seen a 22% dip at the year’s start, sparking speculation about its future in the “Magnificent Seven.”

Real-World Consequences

The surging stock market isn’t just numbers on a screen; it’s starting to reshape the real world. In Silicon Valley, tech workers’ ballooning stock awards are breathing life into a once-stagnant real estate market, with San Jose homes flying off the market faster than in any other major US metro area. Furthermore, the recent uptick in retirements suggests that more boomers are feeling secure enough in their nest eggs to retire, with 2.7 million more retirees in the US than the St. Louis Fed had anticipated.

In summary, as the S&P 500 shatters records, it’s clear that the market’s dynamics are changing, with tech at the forefront and tangible impacts rippling through the economy and society.

Stay up to date on other relevant news in our “Stock Market” section.