Tesla shares experienced a sharp rise early Monday after reports suggested that President-elect Donald Trump is considering implementing a nationwide framework for self-driving vehicles. This potential move could simplify regulations and streamline autonomous vehicle operations across state lines.

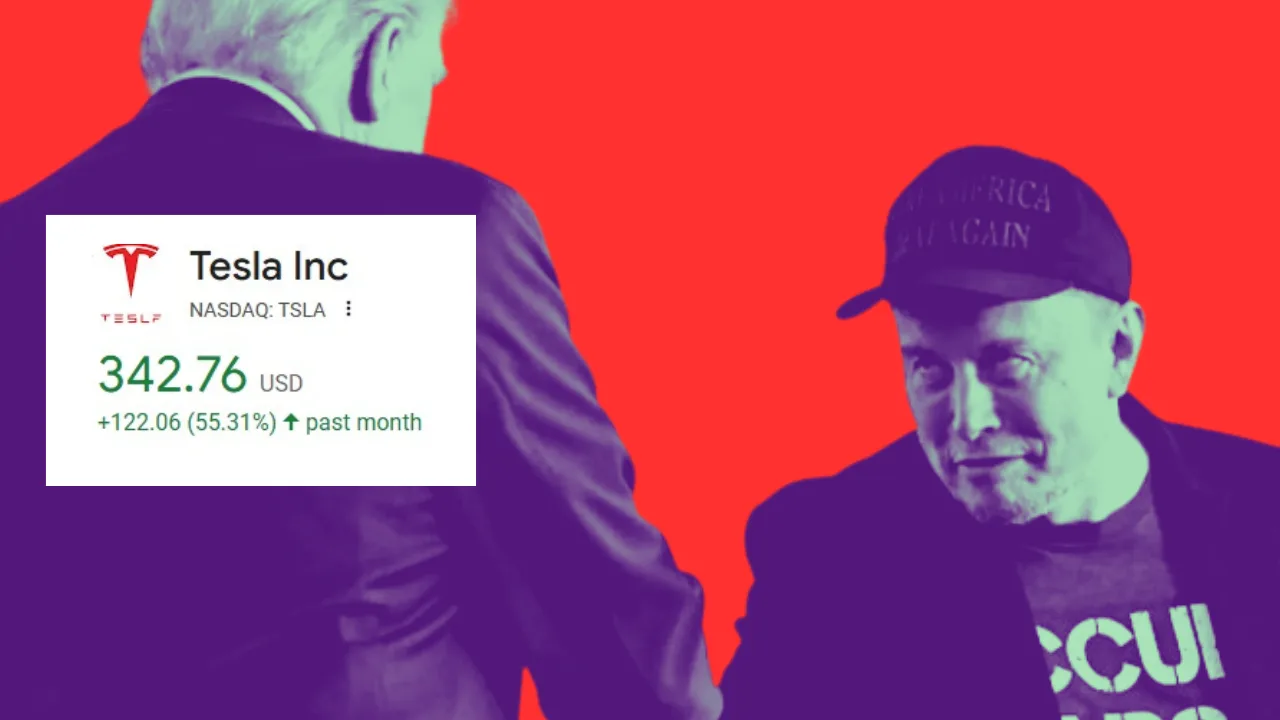

In premarket trading, Tesla’s stock jumped 8% to $346.50 per share. The S&P 500 futures inched up by 0.1%, while Dow Jones Industrial Average futures fell 0.3%. Tesla has not yet issued an official statement regarding these developments.

Federal Self-Driving Regulations: A Game-Changer for Tesla

Currently, state-level regulations govern self-driving cars, creating inconsistent rules across the U.S. A unified federal framework could remove barriers, enabling Tesla to expand its autonomous driving ambitions seamlessly.

“This would be a major regulatory milestone and a significant boost for Tesla’s AI-driven autonomous strategy heading into 2025,” remarked Dan Ives, a Wedbush analyst, in a Sunday report.

Tesla’s Role in Self-Driving Innovation

Tesla’s Full Self-Driving (FSD) software, while advanced, still requires human oversight. However, Tesla is working to achieve full autonomy, aiming to launch a self-driving taxi service by late 2025. The company’s use of AI to improve vehicle performance remains at the forefront of its innovation strategy.

Trump-Musk Alliance: A Strategic Advantage?

Elon Musk’s growing influence within the Trump administration could further bolster Tesla’s position. Musk, who supported Trump’s campaign, has maintained close ties with the president-elect. The two were even spotted together at a UFC event in New York City over the weekend.

“The Trump-Musk alliance is accelerating Tesla’s progress toward its autonomous taxi goals,” said Ives. He emphasized the “golden path” this collaboration is paving for Tesla’s future.

Ives reiterated his “Buy” rating for Tesla, with a price target of $400. Other analysts, like Barclays’ Dan Levy, raised Tesla’s price target to $275 but held a more cautious “Hold” rating.

Challenges Ahead: EV Tax Credit Cuts

Not all policy changes under Trump are favorable for the EV industry. Reports indicate that the administration may eliminate federal EV purchase tax credits. While this could slow industry growth, Tesla’s global scale and cost advantages make it better equipped than competitors to adapt.

Tesla’s stock performance has been strong, gaining 29% in 2024 and 28% since the November 5 election. A federal self-driving framework would further solidify Tesla’s position as a leader in autonomous technology.

Additional Resources

For readers interested in learning more about Tesla’s self-driving advancements and government policy, consider these resources:

- Tesla’s Full Self-Driving Overview: Tesla’s official website

- Bloomberg Report on Self-Driving Regulation: Bloomberg’s Auto Industry News

- Wedbush Analyst Reports on Tesla: Wedbush Research

These links provide further insights into Tesla’s technology and the policy landscape shaping the EV industry.