Trump’s new tariffs are making waves—but will they really avoid fueling inflation? Here’s what top experts are saying and how it could impact your wallet.

What Trump’s Tariffs Mean for the Economy

The Trump administration is set to implement new tariffs on imports from Canada, Mexico, and China, starting March 4. The proposed tariffs include a 25% levy on goods from Canada and Mexico and a 10% tariff on Chinese imports. These measures aim to correct trade imbalances and protect domestic industries.

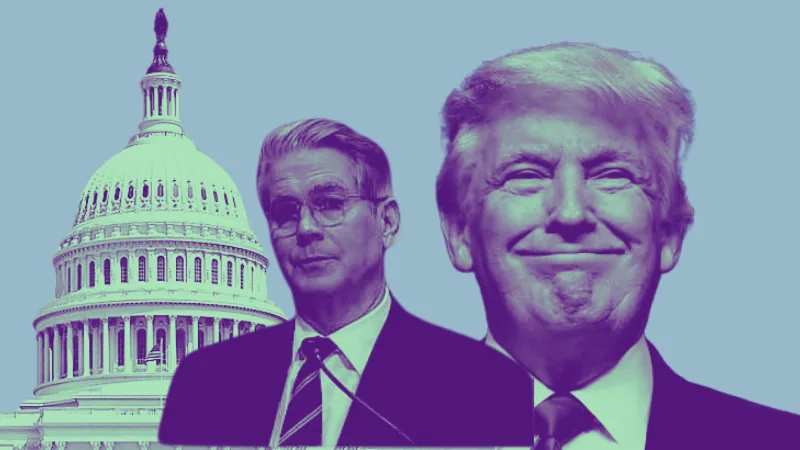

While Treasury Secretary Scott Bessent is confident that these tariffs won’t lead to inflation, market analysts and economists offer a more cautious outlook.

Why Bessent Says Inflation Won’t Spike

Bessent cites historical data to support his position that past tariffs have not significantly driven inflation. According to him, the current economic landscape, including strong domestic production and supply chain adaptability, will mitigate any significant price increases.

Experts Warn of Rising Consumer Costs

Despite Bessent’s reassurances, some financial experts argue that these tariffs could lead to higher costs for consumers and businesses alike. Sectors heavily reliant on imports, such as construction and manufacturing, could see increased expenses, which may be passed down to consumers.

For example, tariffs on Canadian lumber and Mexican drywall could drive up construction costs, worsening the already pressing issue of housing affordability in the U.S.

How This Could Impact You

- Rising Prices: Consumers may see higher costs for goods affected by tariffs, from homebuilding materials to everyday products.

- Market Uncertainty: Investors are closely watching how these tariffs will influence economic indicators like employment data and GDP growth.

- Possible Fed Response: The Federal Reserve may adjust monetary policy based on the tariffs’ economic impact, potentially affecting interest rates and borrowing costs.

The Peterson Institute for International Economics estimates that the proposed tariffs could add an average of $1,200 in annual costs for American households, marking one of the most significant tax increases in recent history.

Final Thoughts

While Bessent stands firm on his stance that inflation will remain stable, concerns persist over rising costs and market implications. Investors and consumers should keep an eye on upcoming economic data, including private employment figures and the February nonfarm payroll report, to gauge the real impact of these tariffs.

The coming weeks will be crucial in determining whether Trump’s tariffs truly avoid fueling inflation—or whether American consumers and businesses will bear the brunt of higher costs.