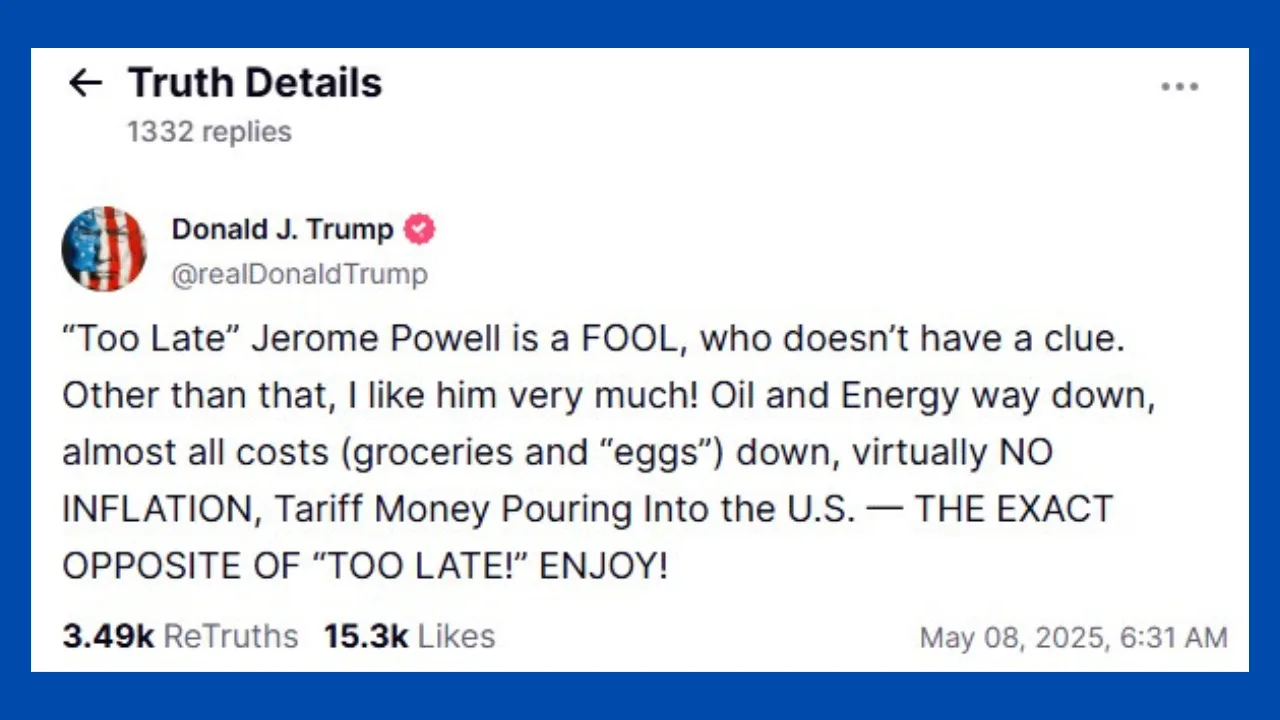

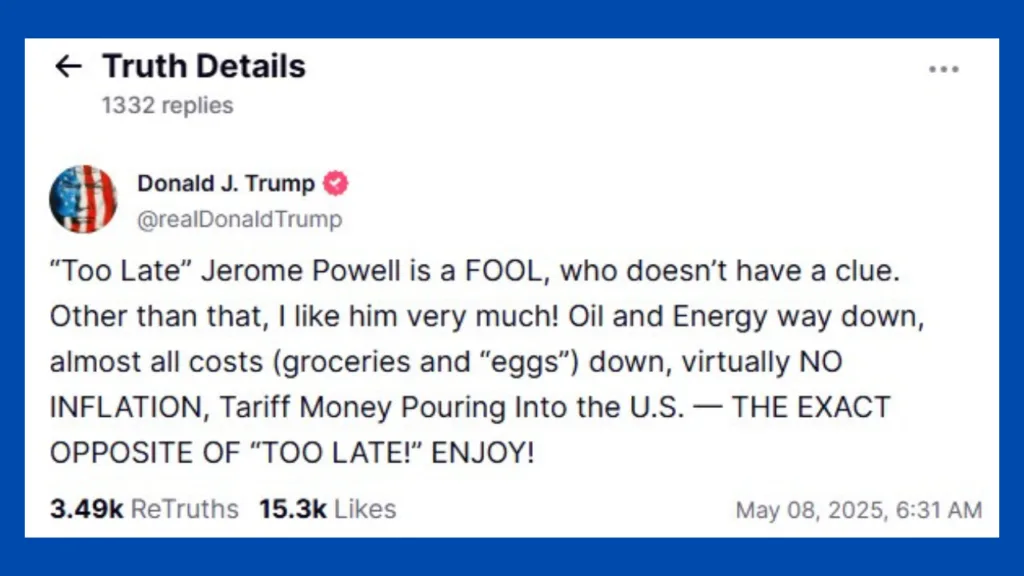

In a now-viral Truth Social post on May 8, 2025, President Donald Trump lashed out at Federal Reserve Chair Jerome Powell, calling him “a fool, who doesn’t have a clue.” The remark came hours after the Federal Reserve decided to hold interest rates steady at 4.25%–4.50%, defying mounting political pressure from the White House to cut rates amid slowing economic growth and rising global trade tensions.

While Trump’s criticisms of Powell are nothing new, this public outburst was one of his most aggressive yet—and it landed at a particularly sensitive time for both the economy and his administration. With the 2025 general election cycle heating up, Trump is making monetary policy a political weapon—and Jerome Powell is now a central figure in that battle.

What Triggered Trump’s Outburst

President Trump’s Truth Social post came shortly after the Federal Open Market Committee (FOMC) released its May 2025 statement, announcing it would not change interest rates despite a growing chorus of calls—including from the White House—to begin loosening monetary policy.

In his post, Trump wrote:

“Powell is a fool who doesn’t have a clue. We need cuts, not this economic torture. Inflation is gone. Growth is flatlining. Wake up, Jerome.”

This marks the second time in less than a month Trump has escalated public attacks on the Fed chair. In April, he suggested Powell’s “termination can’t come fast enough,” a statement that spurred speculation about whether he might attempt to remove Powell before his term ends in 2026.

The Stakes—Why Trump Wants Lower Rates

The context behind Trump’s anger is clear: his economic agenda for 2025—centered on tariff-fueled trade realignment and domestic manufacturing investment—is under pressure. With China retaliating on U.S. tariffs and global demand slowing, business investment has stalled and credit markets are tightening.

Lower interest rates would:

- Reduce borrowing costs for consumers and businesses.

- Stimulate housing and auto markets.

- Juice short-term economic activity ahead of the 2025 election.

But the Fed is signaling it’s not ready. Despite easing inflation, Powell has repeatedly emphasized that rate cuts would only come once the Fed is confident inflation is sustainably at 2%. The Fed also remains concerned about wage inflation and a tight labor market, which could reignite price pressures.

Trump vs. Powell—A History of Tension

Trump nominated Powell as Fed chair in 2017, replacing Janet Yellen. But by 2018, the relationship soured as the Fed raised rates during Trump’s presidency. Trump publicly berated Powell multiple times, even considering firing him, though legal analysts questioned whether he had the authority to do so.

Now in his second term, Trump appears even more emboldened to exert influence. However, Powell, whose term runs through 2026, has stood firm. In a press conference following the May decision, Powell responded to Trump’s criticism by saying:

“We are guided by economic data and long-term stability, not political noise.”

Source – WSJ coverage of May 2025 FOMC Press Conference

How Markets Reacted

The stock market seesawed following the Fed’s announcement and Trump’s post. Initially, equities dipped on the rate hold but later rebounded after investors interpreted Trump’s aggressive rhetoric as a sign that rate cuts might eventually be forced.

Key market reactions:

- Dow Jones fell 180 points immediately after the announcement but recovered by end-of-day.

- 10-Year Treasury yields held steady, showing traders still expect easing later this year.

- Bitcoin rose 3%, with crypto traders betting Trump’s clash with the Fed signals future monetary loosening.

Analysts are split. Some believe Trump’s attacks may backfire, causing the Fed to assert its independence even more strongly. Others argue that Powell’s position could become politically untenable if economic data worsens.

Political Implications—2025 Election Strategy

Trump is already framing Powell and the Fed as scapegoats for any slowdown in the economy. It’s a strategic move: if unemployment ticks up or GDP growth slows, the White House can point to monetary “inaction” rather than policy missteps.

Expect to hear more of this:

- “We had growth teed up. Powell blew it.”

- “The Fed is working against the American worker.”

- “We need an America First central bank.”

While the Fed is legally independent, Trump’s messaging aims to erode public trust in Powell—setting the stage for a potential replacement if Trump wins a third term.

Can Trump Fire Powell?

Legally, firing a Fed chair is murky. The Federal Reserve Act doesn’t provide a clear mechanism for removal, and courts have historically defended the Fed’s independence.

However, Trump has floated creative workarounds:

- Demoting Powell to board member (as he threatened in 2019).

- Citing “cause” for removal (though untested in court).

- Pushing Congress to amend Fed leadership structure.

Though unlikely before 2026, a second Trump term might see Powell replaced early if markets and GOP allies turn against the Fed.

What Investors Should Watch

For investors, this clash is more than political drama—it could shape rate expectations, market volatility, and asset allocation decisions.

Here’s what to monitor:

- Upcoming inflation reports: If CPI or PCE inflation drops, pressure on Powell will rise.

- Employment data: Any labor market softening gives Trump more ammunition.

- Yield curve behavior: If inversion deepens, Fed credibility may come into question.

- Bond market pricing: Futures suggest a 60% chance of cuts by September 2025.

Portfolio considerations:

- Stay diversified: Geopolitical and central bank risk is high.

- Consider rate-sensitive sectors: REITs, utilities, and growth stocks may benefit from cuts.

- Watch for dollar weakness: Trump’s pressure could lead to a more dovish Fed, weakening the USD.

Monetary Independence Under Siege?

President Trump’s attack on Jerome Powell is about more than rates—it’s about control. As the 2025 election looms, economic messaging is merging with monetary policy, putting pressure on what has historically been an apolitical institution.

Whether Powell bends or holds the line will be one of the most important macro stories of 2025—and markets will be watching every word.