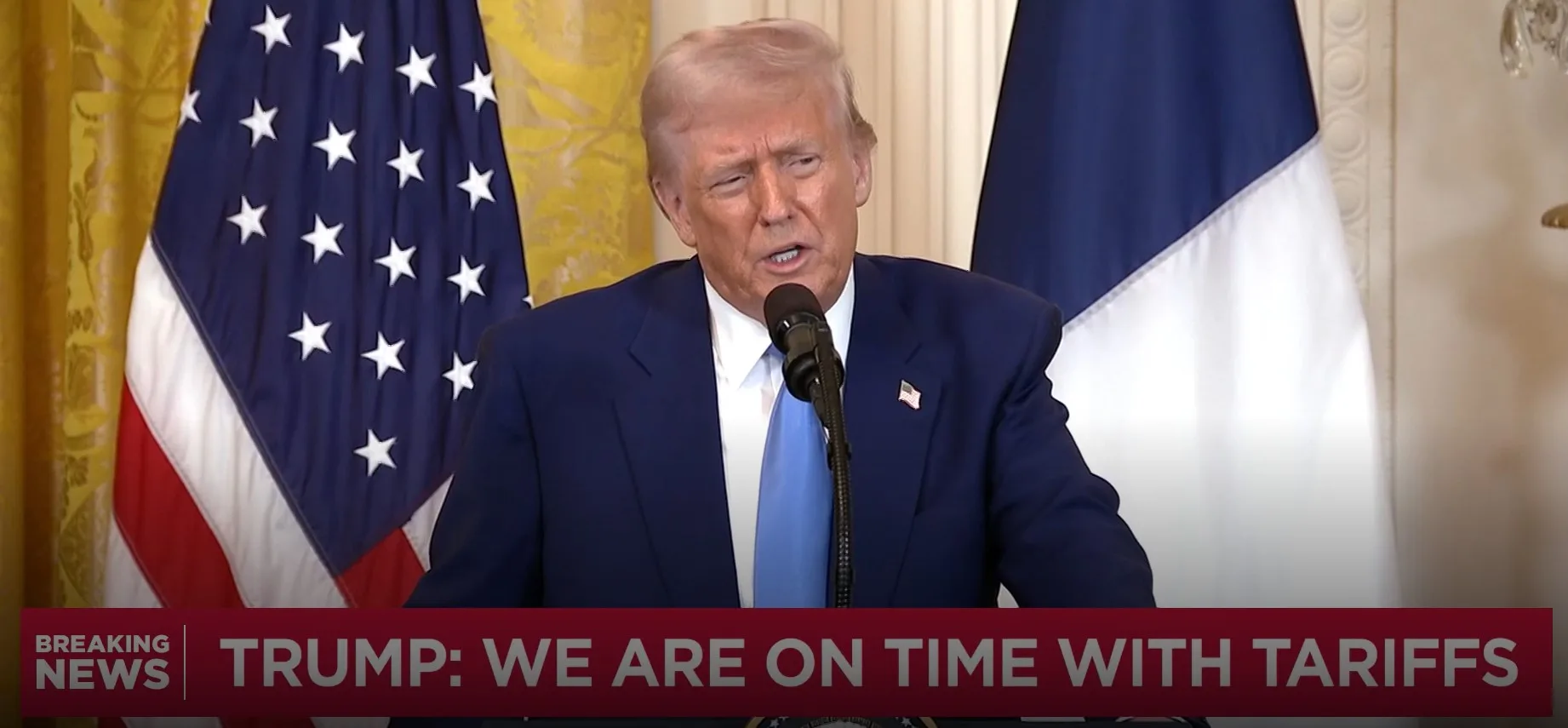

In a bold statement shaking North American trade relations, President Donald Trump confirmed that tariffs on Canada and Mexico “will go forward.” This announcement raises critical questions: Will American consumers face higher prices? How will Canada and Mexico respond? Could this escalate into a full-blown trade war? This article breaks down everything you need to know about Trump’s tariff plan, its economic impacts, and what it means for the future of trade in North America.

Trump’s Tariff Plan: What We Know So Far

Trump’s decision to impose tariffs targets a range of goods imported from Canada and Mexico. While specifics are still emerging, initial reports indicate that automotive parts, steel, and agricultural products will be affected. According to CNBC, the tariffs are slated to take effect in the coming months.

Why Tariffs on Canada and Mexico Matter

Economic Impact on U.S. Industries

Key U.S. industries such as manufacturing, agriculture, and automotive sectors could see cost increases, leading to higher consumer prices. American farmers, who rely heavily on exports to Canada and Mexico, might face declining revenues if retaliatory tariffs are implemented.

Canada and Mexico’s Likely Response

Both Canada and Mexico have a history of retaliating when trade barriers are imposed. Experts predict counter-tariffs that could target American agricultural products, creating a cycle of economic strain on all sides.

Expert Opinions on Trump’s Trade Strategy

According to Dr. Susan Reed, an economist at the Trade Policy Institute, “Trump’s strategy appears to be a bargaining chip aimed at renegotiating trade terms. However, this comes at the risk of alienating key trading partners.” Meanwhile, trade analyst Michael Thompson notes that these tariffs could impact U.S. leverage in global trade negotiations.

How Tariffs Could Affect North American Trade Relations

Impact on the USMCA

The United States-Mexico-Canada Agreement (USMCA) was intended to foster stable trade among these nations. Trump’s new tariffs may undermine this agreement, potentially triggering legal challenges or renegotiations.

Real-World Examples

Major automotive companies have already begun reassessing supply chains. General Motors and Ford, for instance, may shift operations to other countries to offset rising costs, potentially leading to job losses in the U.S.

What This Means for Investors and the Economy

Impact on Stock Markets

Financial markets reacted with volatility following Trump’s announcement. Investors are advised to monitor sectors heavily dependent on North American trade, such as automotive and agriculture.

Reshaping North American Trade Dynamics

Trump’s tariffs on Canada and Mexico could reshape North American trade dynamics. While some argue that these measures will protect American industries, others warn of higher consumer prices and strained international relations. As the situation unfolds, staying informed will be crucial.