On January 20, 2025, President-elect Donald Trump is set to return to the Oval Office, and he’s wasting no time implementing policies that could have a profound impact on the U.S. economy. Trump has announced sweeping tariffs targeting Mexico, Canada, and China, with promises of immediate action on his first day back in office. These measures are already causing ripples across financial markets, and their effects could soon hit your wallet and investment portfolio.

What Are the Proposed Tariffs?

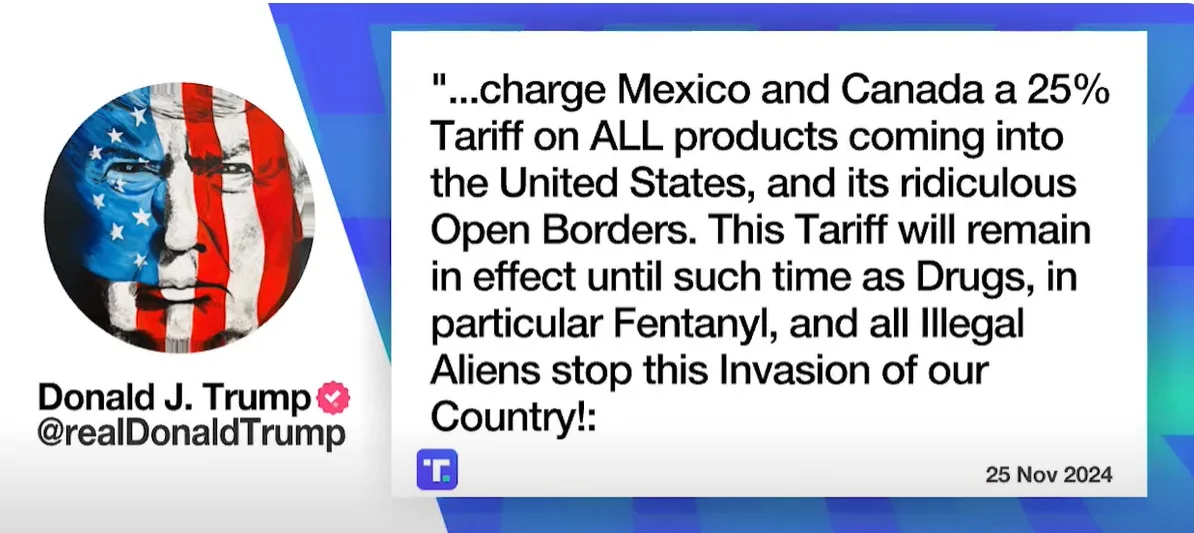

- Mexico and Canada: Trump plans to impose a 25% tariff on all imports from these neighboring countries. The move is aimed at addressing issues like illegal immigration and drug trafficking.

- China: An additional 10% tariff on top of existing tariffs will target Chinese goods, with a focus on pressuring China to combat the export of fentanyl and other illicit drugs to the U.S.

These tariffs are expected to impact industries ranging from automotive to agriculture, reshaping the dynamics of international trade and domestic markets.

What This Means for Everyday Prices

Tariffs act as a tax on imported goods, meaning higher costs for businesses that often pass those expenses on to consumers. Here’s what to expect:

- Groceries and Household Goods: Higher prices for imported produce and everyday items sourced from Mexico and Canada.

- Electronics and Tech: With many components manufactured in China, expect potential price hikes on smartphones, laptops, and other electronics.

- Automobiles: U.S. car manufacturers that rely on parts from Canada and Mexico could face rising costs, impacting car prices.

For example, a $1,000 refrigerator from Mexico could see a price jump to $1,250 under the proposed 25% tariff.

How Tariffs Could Disrupt Your Investment Portfolio

Financial markets are already reacting. The U.S. dollar has strengthened against the Mexican peso, Canadian dollar, and Chinese yuan, but equities in sectors reliant on imports are facing uncertainty. Here’s what investors should watch:

- Winners: Domestic manufacturers may benefit as foreign competition becomes more expensive.

- Losers: Companies with heavy reliance on imported goods or global supply chains, such as tech giants and automakers, could face shrinking profit margins.

- Opportunities: Investors might consider reallocating assets toward sectors like U.S.-based manufacturing, energy, and agriculture.

Expert Insights

Economists are divided on the long-term implications of Trump’s tariff strategy. “Tariffs often lead to higher consumer prices and strained international relationships,” warns Dr. Emily Grant, a trade policy expert. On the other hand, proponents argue that these measures could encourage domestic production and address trade imbalances.

A recent report from the Economic Policy Institute suggests that while tariffs can create short-term disruptions, they might boost certain sectors of the U.S. economy in the long run.

What Should You Do Now?

Given the uncertainty, here are some actionable steps to protect your finances:

- Diversify Investments: Shift part of your portfolio into domestic-focused stocks or ETFs that could benefit from reduced competition with imports.

- Monitor Consumer Spending: Be prepared for rising prices and adjust your budget accordingly.

- Stay Informed: Tariff policies often evolve. Keep an eye on updates to understand their full impact.

Stay Ahead of the Curve

Trump’s tariff policies are shaping up to be one of the defining economic shifts of 2025. Their effects will ripple across industries, markets, and households. To ensure you’re prepared, sign up for our exclusive newsletter and get real-time updates, expert analysis, and actionable advice.