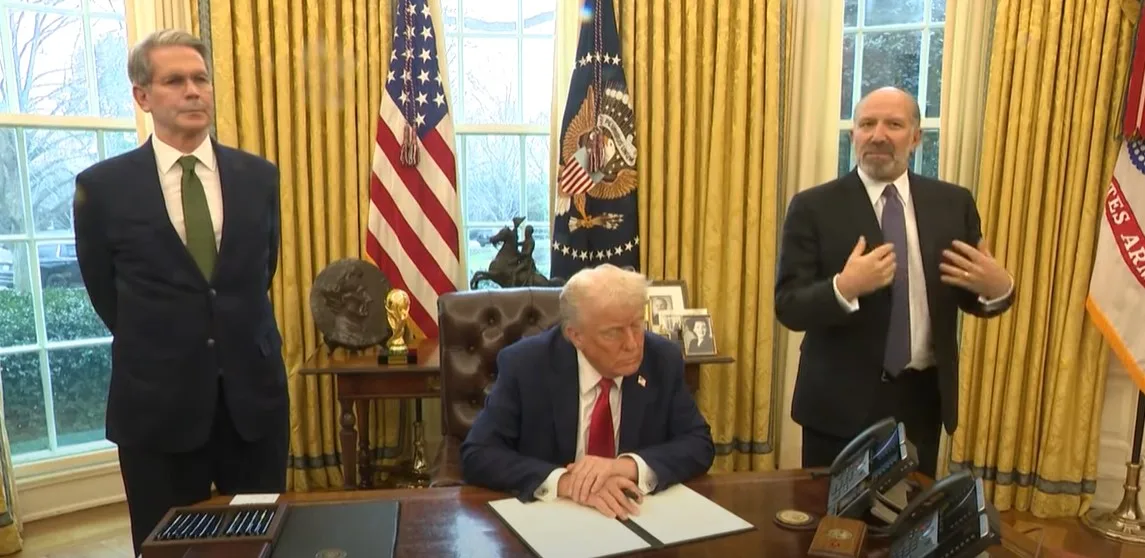

On February 3, 2025, President Donald Trump signed an executive order initiating the creation of the United States’ first-ever sovereign wealth fund. This move, unprecedented in American history, seeks to establish a government-owned investment vehicle that could reshape the U.S. economy. But what exactly is a sovereign wealth fund, how would it work, and why does it matter to Americans? Let’s break it down.

What Is a Sovereign Wealth Fund?

A sovereign wealth fund (SWF) is a state-owned investment fund composed of money generated by the government, often from surplus reserves, natural resources, or other national assets. Countries like Norway, Saudi Arabia, and China use SWFs to invest in global markets, infrastructure, and strategic industries, generating long-term national wealth.

The U.S. has historically avoided this model, preferring private-sector investments. However, Trump’s proposal could change that, potentially creating a fund that would manage national assets and invest in projects to generate returns for American taxpayers.

What Would the U.S. Sovereign Wealth Fund Invest In?

While details are still being finalized, early reports suggest that the fund could be used for:

- Infrastructure Projects – Funding highways, bridges, and other public works without increasing the federal deficit.

- Strategic Industries – Investing in key industries such as energy, semiconductors, and biotechnology to strengthen national security.

- Acquiring Foreign Assets – A controversial idea being floated is the possibility of the U.S. government purchasing a stake in TikTok, the popular Chinese-owned social media platform, to mitigate national security risks.

According to the executive order, the Treasury and Commerce Departments will develop a detailed proposal within 90 days, outlining funding sources, governance structures, and investment priorities.

Why This Matters to Americans

The creation of a U.S. sovereign wealth fund could have far-reaching implications for the economy, national security, and taxpayers. Here’s why it matters:

1. A New Way to Reduce the Tax Burden

If properly structured, the sovereign wealth fund could generate investment returns that reduce the need for higher taxes. Countries like Norway use their SWFs to fund public services, allowing citizens to benefit from government investments instead of relying solely on tax revenue.

2. Strengthening National Security

A government-controlled investment fund could be used to protect critical industries from foreign influence. The idea of using the fund to acquire TikTok, for instance, highlights how the U.S. could leverage financial power to address national security concerns.

3. Long-Term Economic Stability

Rather than funding projects through borrowing, which increases national debt, an SWF could use profits from investments to pay for infrastructure, innovation, and public services. This could provide a more sustainable economic model, reducing reliance on deficit spending.

4. Potential Political and Economic Risks

While the idea of a sovereign wealth fund has clear benefits, there are also concerns:

- Government Overreach – Some argue that government involvement in investments could lead to inefficiencies or politically motivated decision-making.

- Congressional Approval – Establishing an SWF will likely require legislative approval, and opposition from fiscal conservatives or Democrats could stall its progress.

- Risk of Mismanagement – Without proper oversight, the fund could become a political tool rather than a financial asset for the nation.

What Happens Next?

Over the next three months, the Treasury and Commerce Departments will outline a roadmap for the sovereign wealth fund’s structure and operations. Trump’s administration is expected to push for swift implementation, possibly using executive powers to establish the fund before Congress weighs in.

As discussions unfold, questions remain:

- Will the U.S. government truly move toward owning corporate stakes?

- How will investments be chosen?

- Can the fund generate sustainable returns without political interference?

Regardless of the outcome, Trump’s initiative signals a shift in how America approaches national wealth management and economic strategy.

Final Thoughts

The establishment of a U.S. sovereign wealth fund could be a game-changer for the economy, providing an alternative to deficit spending while securing strategic national interests. If implemented effectively, it could reduce the tax burden, strengthen economic resilience, and enhance America’s global financial influence.

However, the success of such a fund depends on how it’s structured, managed, and safeguarded against political misuse. As the plan unfolds, Americans should stay informed about how their government is planning to invest and whether it truly serves their best interests.

Would you support a U.S. sovereign wealth fund? Let us know your thoughts in the comments below.