In a turn that could rewrite the economic narrative, the U.S. economy clocked in a 3.3% growth rate in the fourth quarter of 2023, outpacing the cautious 2% forecast by Wall Street. This robust expansion, detailed in the latest Commerce Department report, marks a departure from the recession many had anticipated.

Behind the Numbers: A Deep Dive

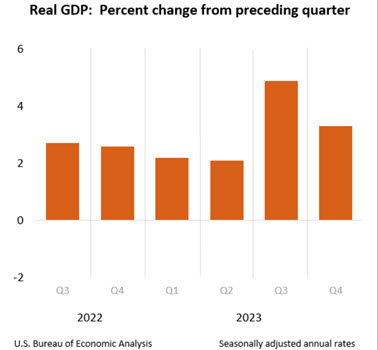

This uptick wasn’t just a fluke. It’s a story of resilience: a 4.9% growth in Q3, followed by this quarter’s impressive performance. Even inflation seems to be taking a back seat, with personal consumption expenditures core prices increasing just 2%. The annual PCE price index also eased to 2.7%, signaling a cooling from the previous year’s 5.9%.

The Consumer Powerhouse: Driving the Economy

Beth Ann Bovino, U.S. Bank’s chief economist, encapsulates the mood: “It’s supersonic Goldilocks.” Consumers have been the unsung heroes, fueling this growth with new car purchases, recreational spending, and travel. Their confidence contributed to the 2.5% annualized pace of the U.S. economy in 2023, a significant leap from 2022’s 1.9%.

Public Spending and Investments: The Unsung Contributors

Don’t overlook the role of government spending. State and local outlays jumped 3.7%, with federal spending not far behind at 2.5%. And let’s not forget gross private domestic investment, contributing a noteworthy 2.1% increase.

Market Sentiments: A Cool Reaction

Despite the positive news, market reactions were subdued. Stock futures ticked up slightly, while Treasury yields dipped. This measured response, according to Dan North of Allianz Trade Americas, stems from the backward-looking nature of GDP data.

The Job Market: A Slight Wrinkle

In other economic updates, initial jobless claims rose unexpectedly to 214,000. It’s a reminder that not all is smooth sailing.

Looking Ahead: Caution Amid Optimism

As we venture into 2024, there’s a blend of optimism and caution. Yes, the Fed’s rate cuts loom, but so do the delayed effects of past hikes. Consumers’ dwindling savings and rising debt are also concerns, along with the colossal federal debt.

Political and Geopolitical Uncertainties: The Wild Cards

Amidst this economic upturn, we can’t ignore the political and geopolitical variables. The intensifying presidential campaign and global tensions, particularly in the Middle East and Ukraine, could reshape the economic landscape.

Final Thought: Resilience Amidst Uncertainty

2023’s economic story was one of resilience, defying recession predictions. As we look to the future, the big question remains: Can this momentum sustain amidst the swirling uncertainties of global politics and economic policies? Only time will tell.

Stay up to date on other relevant news in our “Stock Market” section.