Walmart’s Rise and Target’s Fall: What It Means for American Consumers and the Economy

Introduction

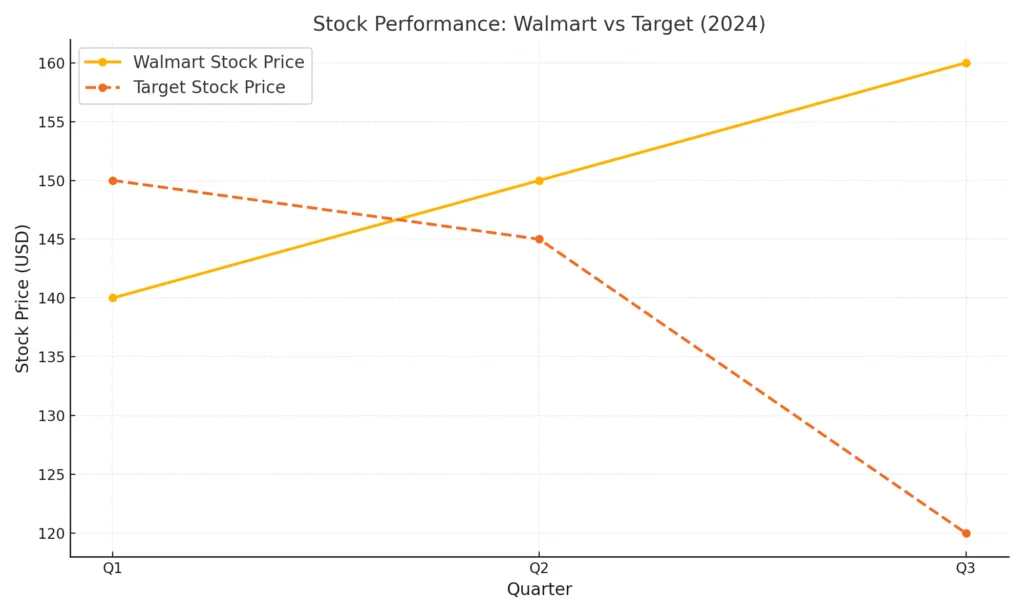

The latest earnings reports from retail giants Walmart and Target paint a strikingly different picture of their financial health—and more importantly, provide critical insights into the state of the American consumer and the economy. While Walmart’s stock has soared to new heights, Target has struggled, leaving investors and analysts questioning what this divergence means. For readers of Global Market News, these trends are not just retail stories—they’re indicators of broader economic shifts that could affect your finances, investments, and purchasing decisions.

Walmart: The High-Performer Adapting to Economic Realities

Walmart continues to dominate with a reported 5.3% increase in comparable U.S. sales for the third quarter, far exceeding Wall Street expectations. What’s driving this success? The key lies in Walmart’s ability to adapt:

- Catering to Affluent Shoppers: Recent data shows that 75% of Walmart’s market-share gains are from households earning over $100,000 annually. As inflation eats into household budgets, even high-income consumers are trading down to Walmart for better value.

- E-Commerce and Convenience: Walmart’s enhanced delivery and pickup options make it a go-to choice for time-strapped families, while its investment in digital advertising boosts profitability.

- Pricing Power: By leveraging its scale, Walmart keeps prices low, winning over cost-conscious shoppers in a challenging economic climate.

These factors have propelled Walmart’s stock to an all-time high, making it a darling of investors.

Target’s Struggles: A Warning Sign?

In stark contrast, Target has stumbled. Comparable sales grew by only 0.3%, well below expectations. The company also slashed its full-year forecast, blaming weaker demand for non-essential items and rising fulfillment costs. Highlights of its earnings include:

- Shift Away from Discretionary Spending: Target’s reliance on categories like home goods and apparel has hurt its performance as consumers focus on essentials.

- Operational Challenges: Rising costs for online order fulfillment continue to eat into profitability.

- Market Reaction: Target’s stock dropped more than 20%, signaling eroding investor confidence.

For investors, Target’s struggles highlight the risks of failing to adjust quickly to changing consumer habits.

What Does This Mean for the American Consumer?

The earnings gap between Walmart and Target provides a snapshot of how economic uncertainty is shaping consumer behavior:

- Price Sensitivity Across Income Levels: Even wealthier Americans are shifting spending patterns, prioritizing value over brand loyalty.

- Discretionary Spending Decline: High inflation and recession fears are pushing consumers to delay or forgo spending on non-essentials.

- Retail Darwinism: In an era where convenience and price dominate, retailers that fail to adapt risk falling behind.

Broader Economic Implications

This divergence also tells us something about the U.S. economy:

- Inflation’s Continued Grip: Despite cooling in headline inflation, persistently high prices are forcing even higher-income households to adjust.

- Shifts in Market Share: Walmart’s dominance underscores the need for efficiency and cost management across industries.

- Economic Uncertainty: Retail performance often acts as an economic bellwether. Target’s struggles could hint at deeper concerns about consumer confidence and spending power.

What Investors Should Watch

For Global Market News readers, understanding these trends is crucial for navigating today’s market:

- Retail Stocks: Walmart’s strength and Target’s weakness could lead to long-term divergence in their stock performance.

- Consumer Staples: Companies offering necessities at competitive prices are likely to outperform.

- Macroeconomic Indicators: Retail earnings are a window into consumer health. Watch these trends to gauge the broader economy.

Conclusion

The contrasting earnings reports from Walmart and Target reflect more than just corporate strategy—they offer a lens into the financial realities of American households. For investors and consumers alike, these stories underscore the importance of adaptability in an uncertain economic environment. Walmart’s ascent and Target’s challenges serve as a reminder that even in retail, the strongest players thrive by understanding their customers’ evolving needs.

Stay informed with Global Market News as we continue to break down the stories shaping your financial future.