In August 2024, the gold price has experienced a significant surge, reaching unprecedented heights. Understanding the factors behind this price movement is crucial for investors, economists, and market enthusiasts who are keen on tracking gold price trends.

1. Geopolitical Tensions and Economic Uncertainty

The gold price has historically been influenced by geopolitical risks and economic instability. As tensions rise in the Middle East and other regions, the demand for gold as a safe-haven asset increases. This trend, coupled with global economic uncertainties, has contributed significantly to the rise in gold price during this period.

Investors typically flock to gold during times of uncertainty, reinforcing its role as a stable store of value. The ongoing geopolitical risks and economic challenges have driven up the gold price, making it a preferred asset for those looking to hedge against potential downturns (J.P. Morgan | Official Website) (Monex).

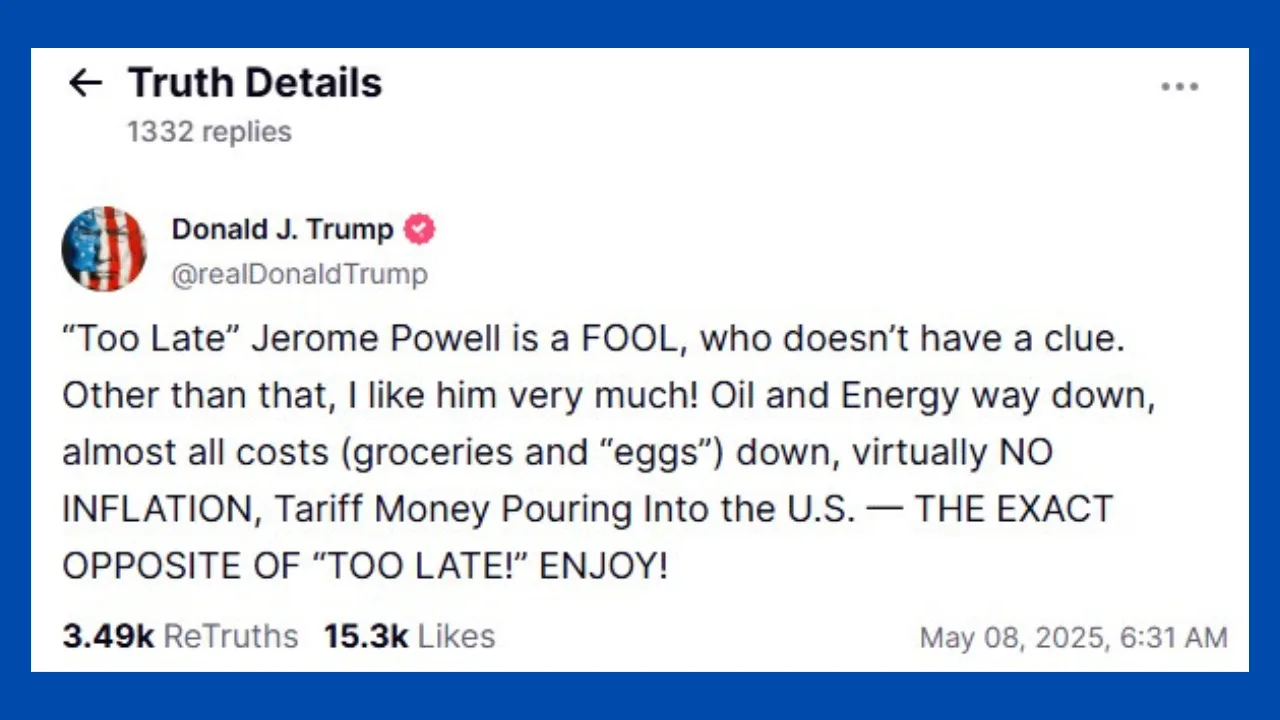

2. Central Bank Policies and Interest Rates

Anticipation of central bank policy shifts, particularly concerning interest rates, has played a crucial role in the rising gold price. The Federal Reserve and other central banks are expected to lower interest rates in response to weakening economic data. This expectation has positively impacted the gold price as lower interest rates reduce the opportunity cost of holding gold, making it a more attractive investment (J.P. Morgan | Official Website) (Morpher).

3. U.S. Labor Market Weakness

The U.S. labor market, a critical indicator of economic health, has shown signs of softening. A weaker-than-expected labor report in July 2024, which revealed a rise in unemployment rates, has added to the surge in gold price. As investors seek to protect their portfolios from potential economic downturns, the demand for gold has increased, pushing prices higher (Monex).

4. Increased Central Bank Gold Purchases

Central banks around the world continue to increase their gold reserves as part of broader diversification strategies. This ongoing trend of central bank buying is another factor contributing to the rise in the gold price. As central banks add to their reserves, the supply in the market decreases, leading to higher prices (J.P. Morgan | Official Website).

5. Market Speculation and Investor Sentiment

Investor sentiment and market speculation have also driven the gold price higher. With prices already at record highs, many investors are reluctant to sell, anticipating further increases. This behavior, coupled with a decoupling of gold from traditional yield relationships, has led to sustained upward pressure on the gold price (J.P. Morgan | Official Website) (DailyForex).

Looking Ahead: What to Expect for Gold Prices

As we move further into 2024, several factors could influence the future direction of gold prices. Central bank actions, geopolitical developments, and economic indicators will all play critical roles. The continued appeal of gold as a hedge against inflation and economic instability suggests that the gold price may continue to rise in the months to come (J.P. Morgan | Official Website) (Morpher).

Conclusion

The surge in the gold price in August 2024 is driven by a combination of geopolitical tensions, economic uncertainties, central bank policies, and investor sentiment. As these factors evolve, gold is likely to remain a focal point for investors seeking stability and protection against market volatility.