November 2023 is witnessing a significant upswing in the performance of the Nasdaq, marking one of its best months in recent times. This surge is attributed to a blend of economic factors and market dynamics. Here’s a deeper look into what’s driving this trend and the potential challenges that lie ahead.

Key Growth Drivers

Softer Jobs Report and Lower Bond Yields

The U.S. economy’s addition of only 210,000 jobs in October, falling short of the expected 450,000, has been a catalyst. This below-par performance led to a drop in bond yields, making stocks more attractive. Lower yields ease borrowing costs and affect stock valuation positively.

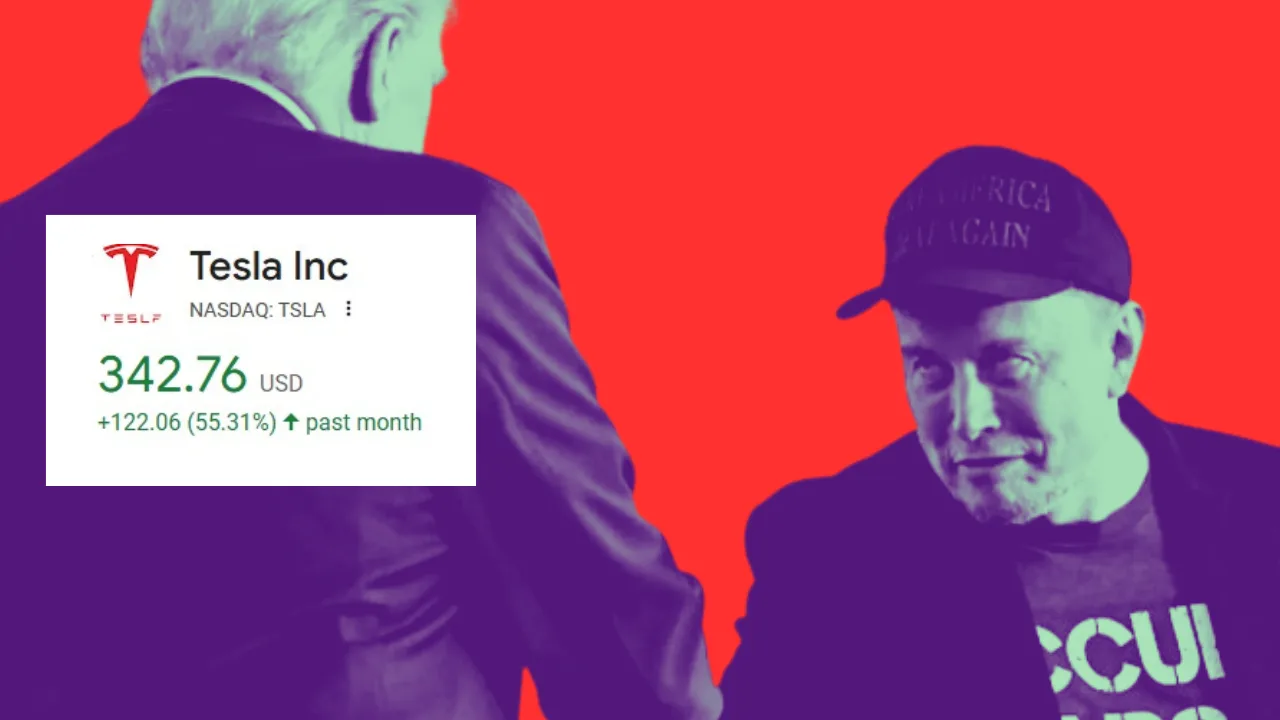

Surge in Technology Giants

A noteworthy rebound in technology stocks, particularly the ‘Magnificent 7’ (Apple, Amazon, Microsoft, Meta Platforms, Alphabet, Tesla, and Nvidia), is a significant contributor. These companies, with their hefty influence in the Nasdaq 100 index, are bouncing back following a sell-off in October. Factors such as robust earnings, innovative product launches, and market dominance are fuelling this recovery.

Positive Seasonal Trends

Historically, the fourth quarter has been favorable for the S&P 500 and Nasdaq 100. This period often brings heightened optimism, influenced by holiday spending, year-end financial planning, and new fiscal year beginnings for many companies, setting the stage for bullish market behavior.

Potential Risks and Challenges

Geopolitical Instability in the Middle East

Escalating tensions in the Middle East, particularly involving Iran, Israel, Saudi Arabia, Yemen, Turkey, and Syria, pose a risk. Any conflict escalation could disrupt oil supplies and create global economic instability.

Declining Consumer Confidence

Falling consumer confidence in major economies, driven by inflation, supply chain issues, labor shortages, and COVID-19 concerns, could impact consumer spending, which is a significant part of the U.S. economy.

Market Cycle Realities

The prolonged bull market, propelled by various economic stimuli and low interest rates, might be due for a correction. Historically, bear markets follow bull markets, suggesting a potential shift may be on the horizon.

Overvalued Market Segments

Particularly in AI and biotechnology sectors, stock valuations are soaring, potentially to unsustainable levels. A correction in these areas could lead to significant market adjustments.

Waning Investor Sentiment

Indicators like increased market volatility, declining breadth, and heightened bearish bets suggest deteriorating investor confidence, which could impact market stability.

Rising Interest Rates

Higher interest rates in the U.S. and other developed markets could increase borrowing costs and make bonds more appealing than stocks, affecting the stock market negatively.

Uncertainty Around Federal Reserve Policies

The Federal Reserve’s actions, particularly regarding bond purchase tapering and interest rate policies, are closely watched by investors. Any unexpected moves could significantly impact market sentiment and behavior.

In conclusion, while the Nasdaq’s performance in November 2023 is impressive, it’s essential to be mindful of the various underlying factors and potential risks that could influence its trajectory going forward. Understanding these dynamics helps in navigating the complexities of the stock