As 2025 dawns, investors face a perfect storm of geopolitical risks, from escalating trade wars to ongoing conflicts and technological rivalries. Understanding these threats and their economic ramifications is essential to navigating an uncertain future. Here’s what you need to know about the top concerns shaping the markets next year.

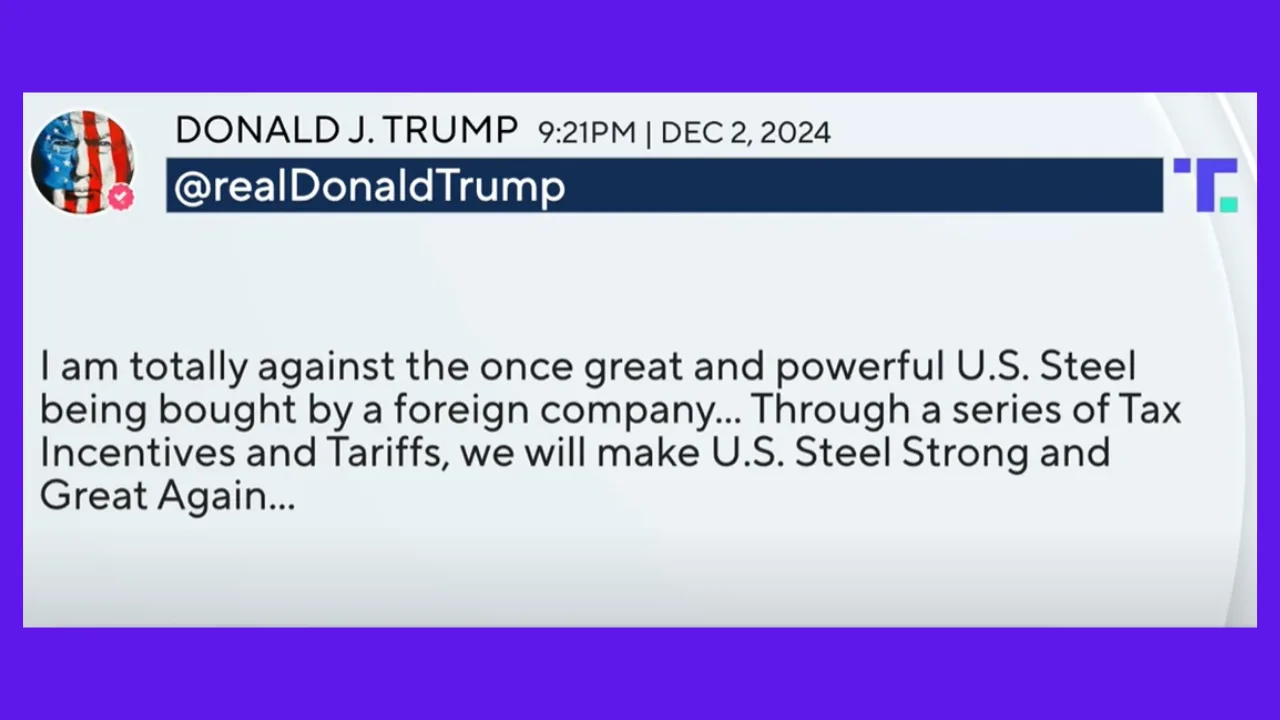

U.S.-China Trade Tensions: A Widening Rift

The Trade War Escalates—Who Pays the Price? The U.S. is doubling down on tariffs against Chinese goods, a move that experts say could stoke inflation and disrupt global supply chains. Other nations, too, are following suit, with rising trade barriers becoming a global trend.

Expert Insight: “We expect the U.S.-China trade war to accelerate, creating supply chain headaches and dampening growth prospects globally,” says Seema Shah, Chief Global Strategist at Principal Asset Management.

The Russia-Ukraine Conflict: Persistent Uncertainty

Europe on the Edge: How the Ukraine War Shapes Markets: The prolonged war in Ukraine continues to rattle Europe, disrupting energy supplies and economic stability. Reconstruction efforts could spur opportunities, but risks remain high.

Expert Insight: “This conflict is a defining moment for European markets—its resolution, or lack thereof, will shape investor confidence,” notes a Financial Times analyst.

Middle East Volatility: Energy Markets Brace for Impact

Oil and Unrest: What Instability in the Gulf Means for You: Recent escalations in the Middle East, including tensions involving Israel, have renewed fears over oil supply disruptions. Markets are bracing for price spikes.

Expert Insight: “A major escalation in the Middle East could trigger capital outflows from Gulf sovereign wealth funds, disrupting global investments,” warns Reuters columnist Mike Dolan.

European Political and Economic Woes

The Eurozone’s Perfect Storm: Instability Meets Stagnation: Political turbulence in major economies like France and Germany, compounded by trade disputes with the U.S., has left Europe in a precarious position.

Quote: “Investors need to keep a close eye on Europe—it’s one of the most vulnerable regions going into 2025,” says Seema Shah.

China’s Slowdown: Ripple Effects for Emerging Market

China’s Troubles Spell Trouble for Global Growth: China’s ongoing struggles, including deflation and a slumping property market, are sending shockwaves through emerging markets that depend on its demand.

Expert Insight: “China’s slowdown will weigh heavily on global trade, with ripple effects most felt in Southeast Asia,” explains a Barron’s analyst.

The Technological Battlefield: A New Geopolitical Front

Tech Wars: How AI and Innovation Drive Geopolitical Tensions: As nations race to dominate AI and advanced technologies, disputes over intellectual property and access to critical resources are intensifying.

Expert Insight: “Technology is the new battleground for global powers—this race could redefine economic and market dynamics,” notes an EY Geostrategic Outlook report.

2025 Test Investors

The year 2025 is poised to test investors with an array of geopolitical challenges, from trade wars to energy crises. Staying vigilant and adopting a diversified investment approach can help weather these uncertainties and even uncover hidden opportunities.