“Dumber than a sack of bricks.”

That was Elon Musk’s blunt assessment of Peter Navarro, one of Donald Trump’s most prominent trade advisers, following a sharp exchange over tariffs and Tesla’s business model. While the jab was vintage Musk — punchy, meme-worthy, and viral — the deeper implications of the spat go far beyond personal insults.

At stake is the direction of American economic policy under Trump’s renewed push for protectionism, the future of global supply chains, and the fallout for investors navigating an increasingly volatile trade environment.

Musk Strikes Back After Navarro Dismisses Tesla

The controversy erupted after Peter Navarro appeared on CNBC and took aim at Elon Musk and Tesla. He claimed Musk wasn’t a true car manufacturer, instead calling him a “car assembler” overly reliant on foreign-made components. Navarro, who served as Director of the Office of Trade and Manufacturing Policy during Trump’s first term, used this characterization to defend new tariffs imposed by the Trump administration in 2025 targeting Chinese electric vehicles and other key imports.

Musk responded on X, formerly known as Twitter, calling Navarro a “moron” and adding:

“This guy is dumber than a sack of bricks. Tesla is the most vertically integrated car company in the U.S. We build our cars from the ground up. Navarro is a known fraud who once made up a fake character named ‘Ron Vara’ to quote in his books.”

The post instantly lit up social media, drawing reactions from business leaders, analysts, and political figures. While some applauded Musk’s candor, others worried the feud signals growing fractures between the Trump administration and the business community.

Who Is Peter Navarro, and Why Is He So Controversial?

Peter Navarro has long been one of the most polarizing figures in U.S. economic policy. An economist by training, he became Trump’s top trade adviser and one of the chief architects behind the administration’s “America First” tariff strategy during the first term.

Navarro’s economic philosophy is staunchly protectionist. He believes that decades of offshoring to China have hollowed out American manufacturing, weakened national security, and made the U.S. vulnerable to supply chain shocks. But his critics — including many in the business and academic world — accuse him of economic illiteracy, intellectual dishonesty, and demagoguery.

One of the most bizarre chapters in Navarro’s career came when it was revealed he had invented a fictional expert named “Ron Vara” — an anagram of his last name — to support anti-China arguments in his books.

To Elon Musk, who’s spent years fighting to build high-tech manufacturing in the U.S., Navarro’s recent attack on Tesla struck a nerve.

Trump’s 2025 Tariff Revival: What Changed?

In early 2025, President Trump unveiled an aggressive new round of tariffs targeting Chinese goods, particularly electric vehicles, solar panels, and raw materials used in battery and chip production. The administration also floated a controversial plan to impose a 10% blanket tariff on all imports, including from long-standing trade partners in Europe and Asia.

The tariffs, according to Trump and Navarro, are intended to boost domestic production, protect American workers, and end what they describe as China’s “economic aggression.” But many economists argue the tariffs will ultimately raise costs for consumers, hurt export-dependent industries, and provoke retaliation from other countries.

The World Trade Organization has already raised concerns about the legality of the measures, and the European Union has threatened counter-tariffs on American agriculture and aircraft.

Musk’s Position: Free Trade and Made-in-America

Elon Musk is no stranger to criticism, but he’s fiercely proud of Tesla’s American manufacturing footprint. In response to Navarro, Musk reiterated that Tesla is the most vertically integrated car company in the country — a claim supported by the fact that Tesla manufactures its batteries, powertrains, and a significant portion of its vehicle components in the United States.

Tesla operates massive Gigafactories in Nevada and Texas, with another facility under development in New York. The company has created tens of thousands of high-skilled jobs in engineering and manufacturing — something few other U.S. automakers can claim at a similar scale.

Musk has long argued that trade wars are harmful to innovation and growth. While he supports reshoring critical manufacturing, he believes that the path forward is through global cooperation and smart supply chain diversification — not blanket tariffs.

“A trade war helps no one,” Musk said in a follow-up post. “We should aim for zero tariffs on both sides, not economic nationalism that ends up hurting consumers.”

How Tariffs Impact Markets and Investors

Beyond the war of words, the renewed trade war carries real implications for investors. Global markets have already begun to show signs of stress, with the S&P 500 down nearly 3% in the last week amid fears of retaliatory tariffs from China and the European Union.

Certain sectors are particularly vulnerable:

- Automotive: Tesla, Ford, and GM all face the risk of cost inflation if they rely on imported components. Chinese EV makers like BYD may also respond with price cuts that flood global markets.

- Technology: Apple and Nvidia, which depend on complex global supply chains, may be hit with retaliatory measures from China.

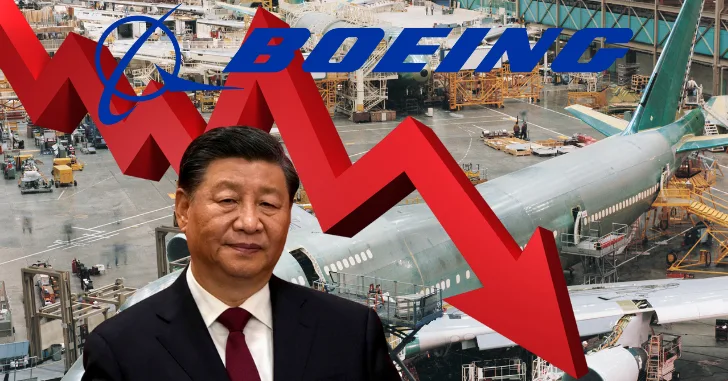

- Industrial: Companies like Caterpillar and Boeing could see overseas orders dry up as tensions escalate.

- Consumer Goods: Tariffs on finished goods and intermediate materials often result in higher prices for American consumers, leading to inflationary pressure.

For investors, this raises serious questions: Are tariffs a temporary negotiating tactic, or the beginning of a prolonged economic realignment? Are U.S. companies prepared to absorb the costs — or will they pass them on?

A Broader Clash of Economic Visions

The Musk-Navarro feud isn’t just a personality clash — it’s a microcosm of a larger ideological battle over America’s economic future.

On one side: Musk’s vision of dynamic, innovative capitalism fueled by free markets, high-tech manufacturing, and international trade.

On the other: Navarro’s protectionist populism, rooted in nostalgia for a bygone era of domestic industrial dominance and economic nationalism.

While Trump himself has at times praised Musk, calling him a “great American innovator,” the tariff fight could test that relationship. If prominent business leaders continue to push back against protectionist policies, the administration may face increasing pressure to adjust course.

What Happens Next?

Several key developments could shape how this drama unfolds:

- China’s Response: Beijing has hinted at retaliatory tariffs targeting U.S. tech and agriculture. An escalation could further rattle markets.

- European Union Trade Talks: The EU is reportedly considering its own countermeasures in response to across-the-board tariffs.

- Business Lobbying: Companies like Apple, Tesla, and Intel may step up lobbying efforts to fight the tariffs.

- Inflation and the Fed: Higher import costs could complicate the Federal Reserve’s efforts to bring inflation under control, potentially affecting interest rates and lending conditions.

Investors, CEOs, and consumers alike will be watching closely to see whether this is the beginning of a long trade war — or just another skirmish in the ongoing battle over globalization.

More Than an Insult

Elon Musk’s takedown of Peter Navarro may have grabbed headlines for its colorful language, but the real story is much bigger. The feud reflects a growing divide over how to keep America competitive in a fast-changing global economy — and whether protectionism is the right answer.

For investors, business owners, and policymakers, this moment is a signal: the rules of global trade are being rewritten, and the stakes are higher than ever.