Unexpected Rise in Unemployment Claims

New data from the U.S. Department of Labor reveals a significant spike in jobless claims, suggesting growing instability in the labor market. For the week ending February 22, initial claims for state unemployment benefits jumped by 22,000 to a seasonally adjusted 242,000. This figure exceeded economist expectations, who had forecasted claims to remain closer to 221,000.

Seasonal fluctuations often impact unemployment claim numbers in early spring, but the magnitude of this increase suggests deeper labor market challenges.

“A rise of this scale is concerning. It suggests underlying weaknesses beyond typical seasonal adjustments,” said Mark Zandi, Chief Economist at Moody’s Analytics. (Source)

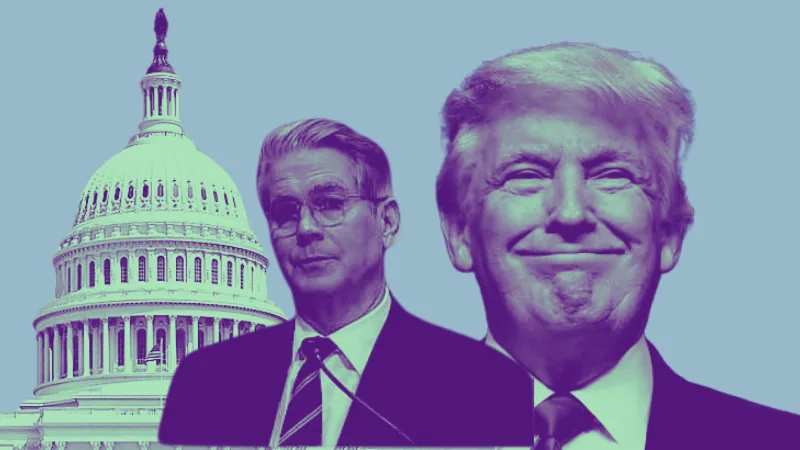

Federal Layoffs Drive Jobless Spike

A major factor behind the increase in claims appears to be a wave of federal job cuts initiated under the Trump administration’s cost-cutting measures. Under the direction of the Department of Government Efficiency (DOGE), led by Elon Musk, federal agencies have been ordered to streamline operations and reduce workforce costs.

The restructuring has already resulted in approximately 29,000 federal employees losing their jobs, with thousands more expected to be affected through buyouts, forced retirements, and administrative furloughs. These cuts span multiple agencies, including:

- The Department of Health and Human Services (HHS)

- The Internal Revenue Service (IRS)

- The Department of Energy (DOE)

Kevin Owen, a labor attorney specializing in federal employment, expressed concern about the broader implications:

“This is an unprecedented downsizing of the federal workforce. The scale of these layoffs could cripple government services that Americans rely on.” (Source)

Market Reaction and Economic Risks

While the Trump administration argues that reducing government spending will improve long-term economic stability, investors and economists are signaling concerns over the immediate impact. Despite efforts to cut costs, market analysts suggest the Treasury yield decline is being driven by weak economic data, not optimism about federal savings.

“This isn’t just about government inefficiency. These layoffs are impacting consumer confidence and market sentiment,” said Liz Ann Sonders, Chief Investment Strategist at Charles Schwab. (Source)

With the labor market already navigating uncertainty, a rising unemployment rate—especially among federal workers, who tend to have specialized skills that may not easily transfer to the private sector—could further strain economic growth.

What’s Next?

As federal layoffs continue and unemployment claims rise, policymakers and economists will be watching closely to see whether the labor market can absorb the displaced workers. The next few weeks of data will be crucial in determining whether this is a temporary shock or the beginning of a larger trend.

For now, both the workforce and investors remain on edge, awaiting further policy announcements and economic indicators that will shape the trajectory of 2025’s labor market.