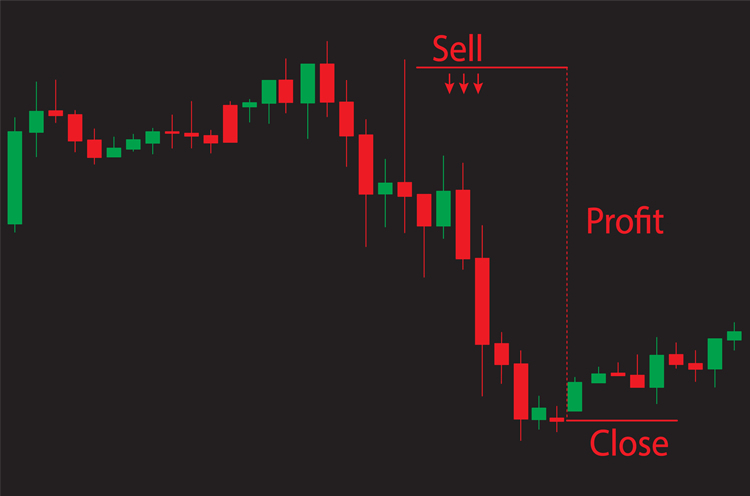

Investors utilize the trading method of short selling to increase their earnings when the value of a securities decreases. In this method, a stock is borrowed from a broker or investment bank, sold at the going rate, and then the same number of shares are bought back at a reduced rate to pay back the loan. The difference between the two prices benefits the investment.

Short sellers stake their money on stocks they think will lose value over time. Because the stock could instead increase in value, short selling can be dangerous. In order to effectively identify which stocks are likely to have negative price changes, it is crucial for investors using this approach to perform comprehensive research.

While holding the borrowed securities in their possession, an investor who shorts a stock is required to pay interest on the remaining balance of their margin account. Margin interest is the name for this expense. Investors should keep these expenses in mind when using short-selling tactics because margin interest rates can change depending on the specific brokerage business being employed.

An investor adopting this method must be aware of the potential hazards involved with shorting stocks in addition to paying margin interest. Short sellers may suffer big losses if a stock’s price unexpectedly rises since they will have to buy back more shares than they originally sold to cover their loan. However, due to limitations imposed by exchanges or listed firms, some investments may not be available to investors who want to use this method. As a result, they might not always have access to certain equities.