President Donald Trump has once again ignited controversy over U.S. monetary policy by sharply criticizing Federal Reserve Chair Jerome Powell, calling for urgent interest rate cuts, and explicitly demanding Powell’s termination. Trump’s latest broadside, delivered via his Truth Social platform, underscores an escalating tension that carries significant implications not only for the economy but also for investors carefully monitoring market conditions.

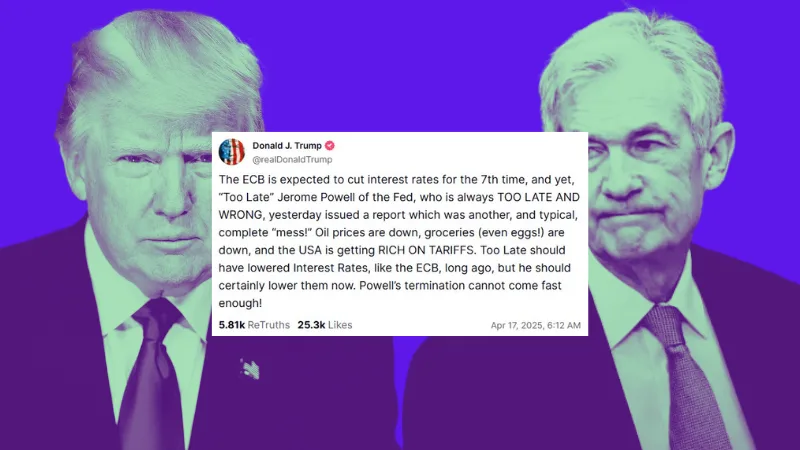

In his recent Truth Social post, President Trump emphatically stated:

“The ECB is expected to cut interest rates for the 7th time, and yet, ‘Too Late’ Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete ‘mess!’ Oil prices are down, groceries (even eggs!) are down, and the USA is getting RICH ON TARIFFS. Too Late should have lowered Interest Rates, like the ECB, long ago, but he should certainly lower them now. Powell’s termination cannot come fast enough!”

Source: Truth Social, @realDonaldTrump

Background of the Conflict

The latest exchange follows a speech given by Jerome Powell at the Economic Club of Chicago, where he described the predicament facing the Federal Reserve due to the Trump administration’s ongoing tariffs. Powell outlined the delicate balancing act between managing inflationary pressures and supporting economic growth, a stance that did not sit well with Trump.

Specifically, Powell commented, “If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.” Powell’s careful language highlights the Fed’s ongoing caution about the economic impacts of tariffs and the uncertainty created by ongoing trade tensions.

This speech reportedly contributed to a significant market sell-off, underscoring investor anxiety about uncertainty in monetary policy and broader economic strategy. It also illuminated the strain between Trump’s aggressive tariff policies and the Fed’s careful calibration of interest rates.

Trump’s History of Criticism Toward Powell

Trump’s recent remarks are far from the first instance of his displeasure with Powell and the Fed’s policies. On April 4, shortly after his administration’s “Liberation Day” tariff announcement, Trump publicly urged Powell to cut interest rates immediately. At that time, Trump stated:

“It would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates. He is always ‘late,’ but he could now change his image, and quickly.”

This criticism aligns with a longstanding narrative Trump has developed regarding Powell—that he reacts too slowly to changing economic circumstances, thereby restricting potential economic growth.

Legal Constraints Surrounding Powell’s Position

Though Trump has repeatedly expressed frustration with Powell, the legality of removing a sitting Fed Chair remains complicated. Powell himself has stated unequivocally that the president does not have the legal authority to fire him. Powell’s term officially ends in May 2026, adding another layer of complexity to Trump’s statements calling for Powell’s immediate removal.

Legal experts generally concur that the Federal Reserve Chair, while appointed by the president and confirmed by the Senate, cannot be removed at the president’s whim. Such protections are intended to maintain the Fed’s political independence—an essential element of its effectiveness and credibility in global financial markets.

Comparing the Fed and ECB: Divergent Paths and Economic Implications

Trump’s remarks also invoke a stark contrast between the policy paths taken by the European Central Bank (ECB) and the U.S. Federal Reserve. While the ECB continues a trajectory of easing monetary policy through repeated interest rate cuts—now anticipated to mark a seventh consecutive reduction—the Fed has adopted a more cautious stance, weighing inflationary concerns against slower-than-desired economic growth.

The ECB’s aggressive rate-cutting reflects ongoing struggles in the Eurozone economy, characterized by sluggish growth, persistent inflation, and geopolitical uncertainties. In contrast, the U.S. has experienced mixed economic signals—robust employment figures juxtaposed against fluctuating inflation data and the lingering economic disruptions caused by Trump-era tariffs.

Trump’s argument suggests the Fed’s hesitance to mirror ECB policies is actively hindering American economic competitiveness. He contends lower interest rates would stimulate economic activity, increase investments, and enable broader consumer spending, positioning the U.S. economy for greater resilience.

Impact of Tariffs and Fed Policy on Investors

For investors, Trump’s renewed calls for rate cuts and his conflict with Powell highlight several critical factors for market strategy. Trump’s tariffs and the Fed’s monetary policies directly affect numerous sectors, including manufacturing, agriculture, technology, and consumer discretionary stocks.

Lower interest rates generally benefit stock markets in the short term, as they reduce borrowing costs and typically boost investor risk appetite. Conversely, uncertainty or open conflict between political figures and monetary policymakers can create volatility, influencing investor sentiment negatively. Therefore, understanding these dynamics is crucial for investors navigating market turbulence.

Additionally, Trump’s frequent references to tariff revenues (“USA is getting rich on tariffs”) highlight a strategy aimed at bolstering U.S. domestic production and revenue. Investors may consider sectors positively or negatively affected by such protectionist measures. Industries reliant on imports may see increased costs and lowered profit margins, while domestic producers and tariff-beneficiary sectors could experience improved competitive positions and profitability.

Practical Investor Guidance

Investors should closely monitor:

- Interest Rate Decisions: Federal Reserve meetings and minutes will provide clearer insights into upcoming policy shifts.

- Sector Impacts: Sectors sensitive to rate adjustments, such as housing, automotive, and technology, could experience significant volatility.

- Currency Valuation: A rate cut could weaken the U.S. dollar, benefiting multinational corporations with substantial overseas revenue.

- Trade-sensitive Stocks: Companies heavily reliant on imports and exports should be evaluated carefully due to their vulnerability to tariff-related policy shifts.

In this environment, investors could consider diversifying portfolios, emphasizing assets that tend to perform well under monetary easing conditions, such as precious metals, certain tech stocks, and dividend-paying equities. Meanwhile, sectors potentially harmed by prolonged tariffs or economic uncertainty may warrant caution or reduced exposure.

Trump’s Comments as a Political and Economic Indicator

Finally, Trump’s public criticism serves as a key indicator of the potential direction of U.S. economic policy, particularly given his influence within the Republican Party and the broader political landscape. With Trump maintaining significant influence over political and economic debates, his criticisms of the Federal Reserve will continue to shape public discourse around monetary policy, influencing investor perception and market expectations.

In conclusion, Trump’s intensified rhetoric toward the Federal Reserve, including explicit calls for Jerome Powell’s termination and immediate rate cuts, signals growing uncertainty around U.S. monetary policy. Investors must stay informed and adjust their strategies accordingly, as policy volatility could directly impact market stability, investor confidence, and sectoral performance in the short-to-medium term.